Elderly Property Scam

Because the population is congested in the city the price of land is high upon the suburbs, and because the price of land is high upon the suburbs the population must remain congested within the city. That is the position which we are complacently assured is in accordance with the principles which have hitherto dominated civilised society. But when we seek to rectify this system, to break down this unnatural and vicious circle, to interrupt this sequence of unsatisfactory reactions, what happens? We are not confronted with any great argument on behalf of the owner. Something else is put forward, and it is always put forward in these cases to shield the actual landowner or the actual capitalist from the logic of the argument or from the force of a Parliamentary movement. Sometimes it is the widow. But that personality has been used to exhaustion. It would be sweating in the cruellest sense of the word, overtime of the grossest description, to bring the widow out again so soon. She must have a rest for a bit.... |

Saving Communities

|

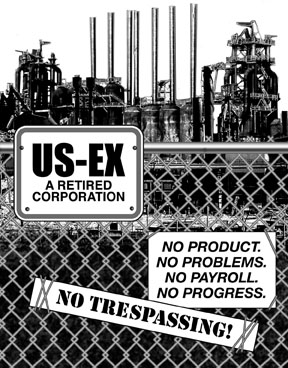

The "Elderly Poor Property Owner" ScamProperty vs. PeopleCritics of property tax say it burdens "elderly poor property owners," and that replacing property tax with other taxes would provide relief for them. It would indeed provide relief for owners of elderly poor properties, even though the owners themselves are not necessarily elderly and are almost never poor.  Failure to adequately tax land speculators and monopolists is a big reason why taxes are so high on the rest of us. It is not just that we pay more because they pay so little; idle landholding is one of the main reasons why government is so expensive in the first place. It contributes to sprawl, blight, spiralling housing costs, loss of business and general economic decline. Residential speculation can be even worse, as it can destroy struggling neighborhoods. Shifting Away from Property Tax Hurts Elderly PeopleIn the long run, all broad-based taxes other than land value tax cost ordinary people people more than property tax. Any savings retired people get from real estate tax cuts will have been offset by increased taxes during their working years, unless they happen to retire when the change takes effect. Even then, proposals to shift away from property tax often cost elderly people with modest incomes more than property tax would cost them. Most elderly people with modest homes in poor neighborhoods pay little property tax, and would pay more if sales tax replaced property tax. Some elderly people keep working, not because they like to work or want to have high incomes, but because they cannot afford to retire. Many of these people also pay more in income taxes. Elderly people also depend on stable housing prices. Shifting away from real estate taxes leads to boom-bust cycles in real estate, and these cycles can destroy the value of retired person's real estate assets. [See: "Where Will You Stand in the Great Housing Crash?"] Elderly RentersReplacing property tax with sales and income taxes not only increases the tax burden on elderly renters, but increases their rents as well. After California and Massachusetts curtailed their property taxes, rents rose faster than before. These are now two of the most unaffordable states in the country. Hiding Behind the ElderlyLand speculators like to "hide behind the skirts of widows," giving more relief to themselves than to the elderly. (See Churchill quote in left column), their proposals . They actually oppose relief that is targeted to elderly people. It is an old tactic that has been used to defend privilege throughout history. Do not be deluded by this widow and orphan business. That is a matter that is always put to the front. When men talked about abolishing slavery in my country, the cry was raised about the widow and the orphan. It was said, "Here is a poor widow woman who has only two or three slaves to live upon; would you take them away?" It reminds me of the story of the little girl who was taken to see a picture of Daniel in the lions' den. She began to cry very bitterly, and her mother said, "Do not cry, do not cry; God will take care that no harm will befall him". To which she replied "I ain't crying for him, but for the poor little lion at the back -- he is so little I am afraid he won't get any." -- "Scotland and Scotsmen," Henry George, 1884 Relief for People, not Property.Elderly people have many burdens besides property tax. They need and deserve our support regardless of how much property they have. Indeed, those who hold property in expensive neighborhoods are the only ones with an option to cash in that property and live elsewhere. Those who rent need the most support of all, as rents have been increasing far more than property taxes.  Because many elderly people no longer produce wealth, they are also dependent on a strong economy that can provide for them. Taxes on productivity weaken the economy and leave the elderly less secure. Sales taxes are particularly destructive of commerce. If we are to help the elderly we must help the elderly poor as much as the elderly rich, and must help elderly people, not owners of elderly property. Real Relief for the ElderlyIf there were no way to give relief to elderly citizens without cutting taxes for speculators and without raising taxes on renters, then one could quibble about how many elderly would do better under some other tax. However, The Founders' Plan gives relief to all elderly people without encouraging land speculation and without increasing sales or income taxes. There are two components to The Founders Plan. The first is to tax the value of land only, without taxing the value of improvements as property tax does. This tends to save money for home owners generally, and for elderly poor home owners particularly. Elderly poor people tend to live on smaller than average parcels in neighborhoods less affluent than average. The second is to give each elderly person a per capita grant from land value tax proceeds. The per capita grant gives relief so effectively that Tom Paine proposed it as a way to give every person over 50 a pension. Paine's pension plan, to be funded from land value tax revenues, was the first social security plan ever proposed. Both Reforms Stand on Their OwnThe experience of 17 Pennsylvania cities is that shifting from property tax to land value tax reduces the tax burden on most elderly home owners, with or without a per capita grant. Conversely, per capita grants would benefit the elderly and allow for more reliance on property tax, even where there is not a land value tax option. Taxing jurisdictions that have either option should use it while they ask state legislatures for the other option as well. They should not move from real estate taxes to economically destructive taxes on income and sales. |

Home Page

|

Saving Communities |