Orwellian Economics

|

Saving Communities

|

|||||||

Home |

Site Map |

Index

|

New Pages |

Contacts |

Get Involved |

Orwellian Economics

How Euphemisms Have Turned Economics from a Science to a Propaganda Device

by Dan Sullivan

The purpose of

Newspeak was not only to provide a medium of expression for the

world-view and mental habits proper to the devotees of IngSoc, but to

make all other modes of thought impossible. It was intended that when

Newspeak had been adopted once and for all and Oldspeak forgotten, a

heretical thought - that is, a thought diverging from the principles of

IngSoc - should be literally unthinkable, at least so far as thought is

dependent on words.

The purpose of

Newspeak was not only to provide a medium of expression for the

world-view and mental habits proper to the devotees of IngSoc, but to

make all other modes of thought impossible. It was intended that when

Newspeak had been adopted once and for all and Oldspeak forgotten, a

heretical thought - that is, a thought diverging from the principles of

IngSoc - should be literally unthinkable, at least so far as thought is

dependent on words.

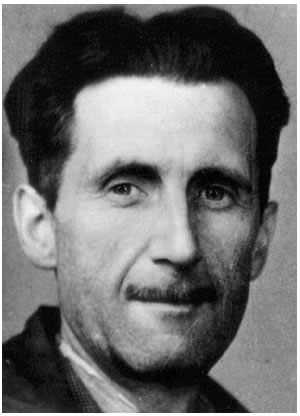

- George Orwell, 1984, Appendix: "The Principles of Newspeak"

The Precision of Scientific Language

Scientific analysis requires precise language, and the "hard" sciences rely on such language. In aerodynamics, for example, the factors of flight are lift, thrust and drag. Each of these factors is rigorously defined, and each is distinct from the other two.

The definitions and principles of aerodynamics are the same whether they are applied to a bird, a glider, or a jet. The nature of a true science is such that definitions and principles remain fixed for all items studied. If they change, it is because they have been found to have been incorrect or incomplete all along.

However, hard sciences are relatively free of interests that are at odds with valid and accurate analysis. (An exception is when they become politicized, as in the case of meteorology and climatology being politicized by the global-warming debate.) Going back to aerodynamics, we see a general desire for successful and reliable flight, and we do not see factions of passengers, each lobbying to insure that "my side of the airplane doesn't crash."

The Exactitude of Classical Economics

While classical economics was not free of political intrigue, sponsors of classical economic theorists had a common interest in maximizing aggregate wealth. That is, kings wanted to maximize the wealth of their kingdoms, in order that they might tap that wealth to defend those kingdoms or to attack other kingdoms. Similarly, nobles wanted to maximize the wealth of their fiefdoms, in order that they might tap this wealth to improve their stature and power.

The rise of the merchant economy had made maximization of wealth far more complicated than it had been during agrarian feudalism, when almost all of the wealth of a community had been produced and consumed locally. The coming rise of industrial production would complicate national economies even more, and nations that had not grasped economic advantages would find themselves dominated by those that had. Whatever their differences, kings and nobles wanted their kingdoms and fiefdoms to out-perform neighboring kingdoms and fiefdoms. English and French economists also had the benefit of seeing how prosperous people became in their American colonies, where there was very little usurpation from landlords. American philosophical leaders saw these things even more clearly.

This is not to say that their were no factional interests. Those such as the French Physiocrats, who worked directly for kings, were more clearly tuned to the national interest, while those who worked for individual nobles tended to be more biased toward the interests of those nobles. Landed interests championed the causes of farmers, to whom they were renting land, while banking interests championed the causes of merchants, to whom they were lending money.

Just as certainly, landed interests did not champion the desire of farmers to see more land thrown open, which would lower rents, and banking interests did not champion the desire of merchants for directly-issued, debt-free money, which would lower payments to creditors. For example, Adam Smith was funded by the Duke of Buccleuch, who was heavily involved in banking. As a result, Smith was far more critical of landlords' behavior with regard to tenants than of creditors' behavior with regard to debtors.

None the less, these economists were

writing for kings,

lords and high ministerial officials, who would consider issues

carefully and would not take kindly to transparent demagoguery. With

the rise of democratic republics (or what passed for such), the demand

for careful, accurate analysis was gradually displaced by demand for

tracts that would pretend to attack established privileges (i.e.,

private

legislations) while supporting the

introduction of new privileges.

Socialist and Anti-Socialist Half-Truths

Karl Marx wrote that, "The materialist doctrine that men are products of circumstances and upbringing, and that, therefore, changed men are products of changed circumstances and changed upbringing, forgets that it is men who change circumstances and that the educator must himself be educated." However, Marx himself was a product of his circumstances, for Germany was the only major European power that did not have colonies in his day, and it showed in his analysis.

Colonists, especially in North America, had experienced free-enterprise capitalism in the near-absence of land monopoly. They had also enjoyed the substantial freedom from bank debt by relying on "colonial scrip" - bills of credit issued directly into circulation by each colony to pay for colonial expenses. Indeed, much of the classical liberalism of England and France had been inspired by communications with colonial populations and by the prosperity of ordinary colonists.

The result was that Americans saw first-hand that capitalism worked very well in the absence of land and banking monopolies, only grinding down the working class after those monopolies became entrenched. The English and French liberals saw this as well, if only indirectly. Marx only saw that Germans and other Europeans had been better off under the paternalism of feudal lords before the introduction of the industrial age, and he blamed capital, writing in The Communist Manifesto,

The bourgeoisie, wherever it has got the upper hand, has put an end to all feudal, patriarchal, idyllic relations. It has pitilessly torn asunder the motley feudal ties that bound man to his "natural superiors", and has left remaining no other nexus between man and man than naked self-interest, than callous "cash payment."

In other words, Marx was upset that

people were doing what they wanted to do instead of what the lords

wanted them to do. He also blamed the

capitalist for the fact

that industrial production enabled the landlord to squeeze the workers,

while classical liberals saw that landed privilege was squeezing

labor and capital alike. In attacking capital as if it were privilege,

Marx resorted to a great deal of redefinition that conflated capital

with privilege. The defenders of privilege delighted in this

conflation, for it not only pushed the actual capitalists into an

alliance with privilege holders, but gave privilege the same legitimacy

as labor-produced capital. They were thus able to counter Marxist

half-truths with mirror-opposite half-truths, and to create such a

furor over the

criticisms from Marx as to drown out the more intellectually sound

criticisms from classical liberals. This was the primary motivation

behind

developing neoclassical economics generally, and Austrian economics

particularly.

The Ambiguity of Modern Economic Terminology

Modern economics is riddled

with influence

from political factions, each focused on its own interests, each

vigorously defending its own privileges and less vigorously decrying

the privileges of others, and each trying

to manipulate economics to support its agenda. The result is a

pseudo-science based on terms with multiple meanings, with expediency

masquerading as utility, and rationalization masquerading as logic. As

we get into the history of how economics has become degraded, we

will examine some of the euphemisms now in vogue and show how they lead

to illogical conclusions.

"Macroeconomics" for "Political Economy"

Economics was originally called "political economy." Its explicit purpose was to analyze public policy alternatives and to advise kings and lords as to the effects of proposed policies. The moral purpose of political economy was ostensibly aligned with the moral purpose of government itself - to maintain order and to promote the general welfare. Modern economics, pretending to be a "pure" science, has stripped away terms that imply a moral purpose. However, we shall see that hidden agendas of interest groups have replaced the overt agendas of kings and of the people, and that these hidden agendas are served by obscuring the political purpose of "macroeconomics."

In many ways, the new economic thinking we have to work out has some close affinities with very old economic thinking, because what I think we need to do is to find a way to reconnect economic reasoning with moral reasoning. The classical economists understood their subject in this way, from Adam Smith, to Karl Marx, to John Stuart Mill - despite their ideological differences - the classical economists did not view economics as a value-neutral science, or even as an autonomous discipline. They all understood it to be a subfield of moral and political philosophy, and I think that we will succeed in recasting, in reinventing economics, when we reconnect it with this long, but largely forgotten tradition.

- INET

presentation by Michael Sandell, Harvard professor of government

and producer/host of the internet course, Justice.

"Normative" for "moral"

Modern economists use the term "normative

economics" for

arguments about what should be, and "positive economics" for arguments

about how things are and what "works." It is often insisted that

positive economics must come first - that what is and what works must

come before what should be. However, this begs the question, "works for

whom?" Often, when there is no explicit moral agenda as to whom

economic policy should serve, it serves an implicit agenda, as

Elizabeth Warren observed in 2004:

What Alan Greenspan focuses on when he talks about the American family is whether or not they'll be able to continue to make the payments on those outstanding credit cards and outstanding loans, because if they can keep making the payments - if they can keep a shoulder to the wheel - then the banks are safe. Ultimately, Alan Greenspan's constituency is just the banks. Just keep those banks safe, and that means everything is happy.

This is the result of macroeconomics having divorced itself of political economy's explicit moral purpose, and it renders "positive economics" positively absurd. If you haven't defined who is supposed to benefit from a policy, how can you define whether that policy "works"? None the less, substituting "normative economics" for "moral economics" avoids calling attention to how amoral, if not immoral, most economics is.

"Maximization of Wealth" for "Satisfaction of Desires"

Although the terminology of classical economics was generally more logical than today's terminology, it defined the whole point of economics in a monarchial context, and that mis-definition has remained with economics to this day. The first economists were employed by kings and high nobles, whose desires were, in fact, the maximization of wealth under their dominion. They had realized that having greater wealth to tap meant having greater military power (for the kings) and greater political influence within the kingdom (for the lords).

Thus, "maximization of wealth" was merely a shortcut for "satisfaction of (kings' and lords') desires." However, as monarchy has been replaced by ostensibly democratic republics, the real point of a proper science of economics would be to efficiently satisfy the desires of the people, both individually and collectively.

We see this proper usage in non-financial contexts, as when we speak of an "economy of motion," meaning that the person or people get the desired results without wasted effort. The point is that what people in democracies want differs from what kings had wanted. For example, they want more leisure time, healthier and more pleasant environments, personal security and quality social interactions. Kings and high lords had these things in such abundance that satisfying such desires was not a priority for them.

Although we have divested ourselves of kings, we have not divested ourselves of privileged interests, and therein lies the problem. A privileged plutocracy dominates economic thought, and that plutocracy is also fixated on the maximization of the wealth they can tap through privilege. As we examine the euphemistic terminology of modern economics, we will see that it consistently serves to protect and enhance privilege.

"Rights" for "Privileges"

"Right" and "wrong" are primarily moral terms, not legal terms. As the purpose of political economy is to advise law-making, letting legal rights determine moral rights in economics leads to circular reasoning. The fallacy of such reasoning was well captured in Mark Twain's Huckleberry Finn, in which Huck had grown up thinking that a master had a "right" to his slaves:

Jim... was saying how the first thing he would do when he got to a free State he would go to saving up money and never spend a single cent, and when he got enough he would buy his wife, which was owned on a farm close to where Miss Watson lived; and then they would both work to buy the two children, and if their master wouldn't sell them, they'd get an Abolitionist to go and steal them.

It most froze me to hear such talk. He wouldn't ever dared to talk such talk in his life before. Just see what a difference it made in him the minute he judged he was about free. It was according to the old saying, "Give a nigger an inch and he'll take an ell." Thinks I, this is what comes of my not thinking. Here was this nigger, which I had as good as helped to run away, coming right out flat-footed and saying he would steal his children - children that belonged to a man I didn't even know; a man that hadn't ever done me no harm.

I was sorry to hear Jim say that, it was such a lowering of him.

The immorality of "rights" to chattel slaves is easy to understand because it no longer involves a right that anyone respects. Still, there are other forms of exploitation embedded in law that embody the economic essence of slavery - making some people work for the benefit of others rather than for their own benefit. Indeed, apologies for these exploitations are remarkably similar to earlier apologies for chattel slavery. In any case, confounding legal privileges with "property rights" debases economics as a science, and even debases genuine rights to property.

Wealth as a euphemism

Genuine wealth is an undeniably good thing,

contributing to the well-being of the nation. Even those who disparage

the wealthy chide them for not "sharing the wealth." Because the

production of genuine wealth is praiseworthy, those who benefit from

less praiseworthy things refer to those things as wealth. Many in the

socialistic faction of the left have embraced this confusion in their

attacks against wealth, and their

analysis has suffered as a result.

"Wealth" for "Claims upon wealth or labor"

A person might be far more "wealthy" in claims to wealth than in actual wealth. Indeed, most of the assets of wealthy people consist of claims to future production rather than to actual, existing wealth. Classical economists understood that aggregate wealth is neither increased nor decreased by claims upon wealth, except as these claims affect production. As genuine wealth is the product of human labor, the only way to increase genuine wealth is to increase productivity.

That is, one person's claim to wealth that he has not produced is another person's obligation to give up wealth he has produced, with zero net benefit to society. A nation of masters and slaves is no wealthier than a nation of free people, even if each slave has a selling price. Nor is national wealth increased by replacing freeholders with landlords and tenants, nor by replacing financially independent citizens with debtors and creditors, nor by tariffs that allow domestic producers to charge more to domestic consumers, nor by licensed monopolies, subsidies, etc.

Claims upon wealth are not limited to wealth that is already produced, but mostly involve claims upon those who are producing wealth or might produce it in the future. Thus, a patent on a device or process is a claim against anyone who might want to produce that device or use that process. The values of copyrights, patents, licenses, land titles, stocks, bonds, debt instruments, contracts and even slaves are claims against wealth, and not wealth itself.

Each of these claims to wealth is subject to analysis as to whether it is voluntary or coercive, morally right or privileged, and contributory or obstructive to genuine wealth production. Confounding them all with genuine wealth short-circuits this important analysis and makes it easier for privileged interests to rationalize government actions that increase the value of their claims to wealth that is produced by others.

We will examine many euphemisms and dysphemisms in the context of how economics has deteriorated. First, however, we will examine core euphemisms that lead to these other euphemisms.

"Wealth" for "Privilege"

The essential difference between wealth and privilege is that wealth is produced by labor, while privilege (from "private legislation") is conferred by government. Government-issued privileges do not merely grant permission, for everyone had permission prior to government intervention. Rather, they grant exclusive permission, meaning they exclude anyone but the privilege-holders from doing what all previously had a right to do.

Wealth production is a "positive-sum game," in that some people producing and keeping wealth does not make others poorer. Privilege creation is a zero-sum game at best.

"Wealth" for "Land"

If the value of land were equivalent to wealth, Japan would be wealthier than the United States. That is, so many Japanese are so crowded onto so little land that rents are extremely high, and the aggregate selling price of Japanese land is much higher than that of US land. Similarly, San Francisco would be the wealthiest city in the US, as San Francisco homes in 2005 sold for 12.6 times the median income of that city. In reality, high land prices only mean that Japanese and San Franciscan residents are saddled with paying more to Japanese and San Franciscan landlords, to the overall detriment of their economies.

"Wealth" for "Money"

The

confusion between wealth and money leads to many other confusions,

which we will discuss below. However, it should be clear that

increasing or decreasing the money supply of a nation does not increase

or decrease its wealth. Real wealth has a real purpose, apart from

money's purpose of claiming whatever wealth is for sale for that amount

of money.

This

confusion also underlies the idea that gold is a

natural money, because gold (at least mined and refined gold) is

wealth. That is, because it located, extracted and refined, at

least a portion of its value results from production. Gold can also be

used as wealth, for filling teeth, coating electronic

parts, or providing ornamentation. However, its use as wealth precludes

its use as money, and vice versa. A thorough explanation of

why even gold-money is not wealth requires a separate essay. However,

it should be obvious enough that a

rich strike that increases the supply of gold will not increase the

supply of what gold-money can buy.

It

should also be clear that a fiat making gold legal tender

dramatically increases the demand for gold and increases its value.

Such a fiat confers a valuable privilege upon those who have

hoards of

gold, giving gold a far greater claim to genuine wealth than it

would have had without that fiat, especially if government requires

wealth producers to pay rents, debts or taxes in gold or gold notes.

"Produce" or "provide" for "permit"

"Produce" does not translate into "create," but into "draw out." It is impossible to produce without access to land and natural resources, and some production is also obstructed by licensed privileges. Furthermore, modern, specialized production requires extensive exchanging, and extensive trade requires money. However, that does not mean that the person holding title to the land, to the resourcing bearing mines or wells, to the patent, license or franchise, or to the money-issuing mechanisms produces anything other than permission. The title, franchise or license is itself a document from the state, granting exclusive and transferable permission to the holder, but neither did the state produce anything but prohibitions and permissions, either.

Prior to the state system of land titles, anyone could take up and use land, subject to the customs of the community, which was usually a tribe or clan. Prior to various other licenses, anyone could move furniture, cut hair, prepare meals, drive taxis, teach, lend money, sell liquor, represent clients in court, etc.

There is a rationale for each of these privilege/prohibition combinations, and good rationales for some of them, although even in these cases there is a tendency to overreach and thereby confer monopoly advantages to privilege holders at the expense of everyone else. In any case, it is not legitimate to equate workers who produced products or services with privilege holders who "produced" permission to do so.

"Invest"for "Acquire"

To "invest" originally meant to put

something into,

without necessarily acquiring anything. It is still used that way, as

when one invests in the education of one's child, or invests time

helping a

worthy organization. Quite frequently, people have both invested in a

business and acquired an interest in that business. For example,

someone might buy a new ship for a merchant company in exchange for

acquiring an interest in that company.

Often, however, one acquires ownership of

a company without actually

investing

anything in that company. For example, one can buy out a business

partner. The proceeds go to the person from whom the ownership is

acquired, not to the business itself. Thus, nothing is actually

"invested." With regard to stock purchases, only IPOs (initial product

offerings) involve actual investment, as the proceeds of the IPOs go to

the actual operations. Subsequent transfers of stock from one holder to

another

are mere acquisitions, not investments. A statement like, "I just

invested in General Motors," should tempt one

to ask, "What did you buy them - a new fender stamper? A cylinder

hone?" If all that person did was acquire General Motors stock from

another holder, he "invested in" nothing, and the productive operations

of

General Motors are not affected.

This is not to disparage acquiring per

se. After all, some investors

put money into a business with the intention of selling off their

interest in that business, and can only accomplish the sale if someone

else acquires what they have. Nor do we particularly object if someone

would rather refer to himself as an "investor" than as an "acquisitor."

The real problem comes when politicians adopt incentives "to encourage

investment" that actually encourage acquisition. The result is not an

increase in productivity, but an inflation of prices into "bubbles,"

and the crash that inevitably follows.

"Building equity" for "inflating prices"

The original meaning of "equity" is

"fairness or justice in the way people are treated." In today's

economic Newspeak, it means "the value of a piece of property (such as

a house) after any debts that remain to be paid for it (such as the

amount of a mortgage) have been subtracted."

Policies that claim to help home owners

"build equity" actually just

inflate the prices of homes, so future home buyers (including the

children of today's home owners) have to pay that inflated price. The

big winners are the mortgage lenders, who are collecting interest on

larger 40-year mortgages instead of on smaller 20-year mortgages as

they did in the 1960s.

Where's the "equity" in that?

"Income" for "earnings" (and vice versa)

Originally, "earnings" was what one received for working - whether as a wage worker or as an entrepreneur actively managing a business. "Income" meant that which comes in - dividends, rents, interest payments, etc. As flawed as income tax was, it was not originally intended to fall on returns to productive efforts. Today we speak of the "earnings" of stocks and bonds, and the "income" of labor. This is exactly backwards, and stems from the desire of privilege holders to pretend that the revenue they receive has the same legitimacy as the returns to productive effort.

Some have attempted to resurrect the distinction with terms like "passive income," "unearned income" and "windfall profits," but the conflation of income with earnings continues to confuse economic thinking for the benefit of privilege holders.

"Spending" for "Exchanging"

When a candle, a tire, or a barrel of oil is spent, that candle, tire or oil is no longer usable. But when money is "spent," there is just as much usable money as before; the difference is that somebody else has it. To the individual, it's just as gone as the candle, but to society, there is no loss at all. That's because money is not spent in the same sense as goods are spent. It circulates through the economy by being exchanged, and even when it is worn out it is exchanged for fresh money.

Moreover, it is impossible to have

complex industrial

production without exchange. So, when conservatives say, "Every

businessman knows you can't

spend your way into prosperity," it would only make sense if they were

talking about spending irreplaceable resources. To the contrary,

conservatives tend to claim that the economy depends on profligate consumption

of such

resources. Rather, they are speaking against spending money. And

because

we actually exchange money in

order to get what someone has produced,

what these conservatives are actually saying is, "You can't produce and

exchange your way into prosperity." That is clearly absurd, because

producing and exchanging wealth is the only way to prosperity.

Besides, the actual saying in business is

just the

opposite: "It takes money to make money." That is, you have to spend

money to produce before you can exchange the product for more money.

Any business that is not busily spending its way into prosperity is

preparing for bankruptcy. Government spends to produce conditions which

make economic vitality possible, and this, in turn, produces land value.

This confusion exists because we use

the ambiguous term

"spend" for the very different terms, "consume" and "exchange."

"Saving" for "Hoarding"

The confusion between wealth and money

has led to

confusions between saving and hoarding. True wealth loses value over

time, but people can produce more of it. On the other hand,

money and other claims against future production grow in value the more

productive the economy is. Piling up such claims increases burdens on

producers without increasing the total stock of goods.

Saving true wealth means acquiring

productive machinery and stocking

warehouses with products. It prevents the damage of an approaching

hurricane or typhoon from being aggravated by an acute

shortage of plywood, an unexpected blizzard by a shortage of

snow-removal products, and so on. Genuine savings promotes economic

resiliency, while the hoarding of privileges weakens resiliency.

Are we really better off because some

people have collected

money and withheld it from the rest, who must then borrow to have

access to

the means of exchange? Is it any better than some people bidding up the

price of stocks, or housing, or anything else, instead of actually

increasing the production and accumulation of genuine wealth?

Yet when politicians talk about rewarding

savings, they are usually

talking about rewarding those who hoard money, not those who increase

the supply

of wealth.

"Debt limit" for "money-supply limit"

Modern money comes into circulation in one of two ways. Either private banks make real, enforceable loans to private borrowers, or central banks make fictional loans to government. In both cases, credit created out of thin air becomes monetized (turned into money). The fictional loans to national governments do not have to be paid off, and, at least in the United States, interest on these loans is forwarded to the Treasury. This is called "deficit spending," and it is the only kind of money creation that does not also create genuine, enforceable debt. Yet, when we limit this kind of money-creation, we call it a debt limit.

A true debt limit would limit the amount of

government bonds

the central bank and the treasury could sell to private interests, and

the amount of credit the central bank may allow commercial

banks to extend. Limits on the amount of money government may create

thorough deficit spending should be called a "money limit." Certainly

in times of economic collapse, apologists for creditors would have a

more difficult time saying we have too much money if they could not get

away with saying we were creating

debt.

There can indeed be too much money, but

that is still a different thing

from

too much debt. A true debt limit that curtailed

the creation of money by banks would allow more creation of debt-free

money by government. By getting the public to believe that limiting the

creation of debt-free money is actually limiting debt, bankers and bond

holders can prevent us from ever having the means to pay down these

debts.

"Inflate" for "increase"

To inflate is to fill with air. It is a

good metaphor to use

when prices rise because the money supply has increased more than the

supply of goods and services the money can buy. However, some

economists, especially those with a tight-money agenda, refer to any

increase in the money supply is "inflating" that supply. When

questioned, they will tell you that monetary inflation and price

inflation are two different things, but they use the words "inflate"

and "inflation" for both. It would be less misleading to use "inflate"

only when it results in price increases, and simply say that a policy

"increases" or "expands" the money supply when no price increase has

been demonstrated.

"Fair" for "generous"

Today's economists and advocates rarely discuss fairness or justice as a fundamental principle. Indeed, one will hear the terms "unfair" or "unjust" far more often than "fair" or "just," and will usually hear that a measure is unfair to this or that interest group, without reference to why it is fair or unfair in general.

Classical liberals had clear ideas of justice and fairness. Although those in Europe had to tread lightly on the unfairness of noble privilege, those in America were not under such constraints. They, and the early progressives who followed them, understood that there was no such thing as government being "more than fair," any more than a referee could be more than fair to some competitors without being less than fair to others.

Moreover, any substantial departure from genuine fairness in the distribution of wealth diverts energy from the production of wealth. Those who benefit from unfair advantages turn their attention to maximizing those advantages, while those who suffer from the consequent disadvantages become demoralized and less productive. "Gaming the system" is not productive.

So long as the State stands as an impersonal mechanism which can confer an economic advantage at the mere touch of a button, men will seek by all sorts of ways to get at the button, because law-made property is acquired with less exertion than labour-made property. It is easier to push the button and get some form of State-created monopoly like a land-title, a tariff, concession or franchise, and pocket the proceeds, than it is to accumulate the same amount by work. Thus a political theory that admits any positive intervention by the State upon the individual has always this natural law to reckon with.

- Albert Jay Nock, The Gods' Lookout

These euphemisms prevail partly because those who benefit from privilege will not bear an examination of that privilege in the context of justice, and partly because the socialistic faction of the left has found itself unable to reconcile its proposals with such an examination. A return to the writings of America's classical liberals and classical progressives shows that they had clear, sharply drawn ideas of economic justice:

As to what is the just distribution of wealth there can be no dispute. It is that which gives wealth to him who makes it, and secures wealth to him who saves it. So clearly is this the only just distribution of wealth that even those shallow writers who attempt to defend the existing order of things are driven, by a logical necessity, falsely to assume that those who now possess the larger share of wealth made it and saved it, or got it by gift or by inheritance, from those who did make it and save it; whereas the fact is, as I have in a previous chapter shown, that all these great fortunes, whose corollaries are paupers and tramps, really come from the sheer appropriation of the makings and savings of other people.

And that this just distribution of wealth is the natural distribution of wealth can be plainly seen. Nature gives wealth to labor, and to nothing but labor. There is, and there can be no article of wealth but such as labor has got by making it, or searching for it, out of the raw material which the Creator has given us to draw from. If there were but one man in the world it is manifest that he could have no more wealth than he was able to make and to save. This is the natural order. And, no matter how great be the population, or how elaborate the society, no one can have more wealth than he produces and saves, unless he gets it as a free gift from some one else, or by appropriating the earnings of some one else.

- Henry George, Social Problems, Chapter 9, "First Principles"

"Means of Production" for "Land, Labor and Capital"

In classical economics, the three

factors of production

are "land," "labor" and "capital." (Adam Smith said "land, labor and

stock.")

Each factor is a distinct, tangible thing, exclusive of the other two.

Land is all that exists in

nature, from fertility of soil to wavelengths in the electromagnetic

spectrum. Labor

is simply any human being engaged in production, whether with his body

or his mind, and whether as an employee, manager or entrepreneur.

Technically, labor can

produce wealth from land without capital or stock, but only at a

primitive level. For example, a person might pick wild foods and eat

them, or catch game with is bare hands and eat it. Those foods and that

game, between the time of picking or catching and the time of eating,

are wealth to him.

However, serious wealth production is more indirect than

that. He might fashion a crude plow to plant his own foods, or make

weapons with which to hunt. These things are also produced wealth, but

they are not produced for mere consumption, but to aid future

production. Classical economists defined wealth

used to create more wealth as capital or stock. That is, true capital

or

stock is materials produced by labor from land, used to aid future

production.

Perhaps the first major step toward Orwellian economics was when

Marx lumped all of these factors into "the means of production," saying

that the revolutionary workers' state "must control the means of

production." Classical liberals understood that controlling the means

of production effectively meant controlling land, labor and capital,

or, in essence, controlling everything.

The proposal to control everything would not stand up to criticism,

even when described abstractly to conceal its implications. It led to a

great deal

of backpedaling and redefining by socialists, creating other

euphemisms and misleading terms. Ironically, defenders of privilege

would embrace these socialist redefinitions in order to conflate their

privileges with legitimate property.

"Capital" for "Everything"

Rather than say that they would control everything, Marxists had to equate "the means of production" with "capital," meaning that they had to give new meanings to the word without openly redefining it until their new meanings had stuck.

I have searched and inquired, and I have not found an instance of Marx offering a formal definition of Capital. Inthe first of Marx's Economic and Political Manuscripts of 1844, he says that "capital is accumulated labor,"which is close to the classical definition, but then criticizes "the political economist" for saying that "capital is nothing but accumulated labor." Well, then, what else is it?

In Marxian Economics: A Popular Introduction to the Three Volumes of Marx's "Capital" (1906) Ernest Untermann writes,

Capital is not a mere thing. It is fundamentally an economic relationship between an exploiting and an exploited class. Without class rule, capital as an economic category has no existence. Land may be capital. Tools may be capital. Articles of consumption and raw material may be capital. But none of these things are capital unless they... be means to rob the laborer of the product of his toil.

The definition of capital at the marxist.org website continues this tortured reasoning, and justifies its including land as capital by citing a king stating that he was making "a capital grant" of land. However, economists hadn't been using the term that way, for good reason. (Imagine the damage to aerodynamics as a science if scientists had let the sloppy usage of some king define aerodynamic terminology.)

Marx's central thesis is that capital exploits labor, and now we see capital redefined as a "relationship" that exploits labor. We are left with a profound conclusion: a relationship that exploits labor exploits labor. It is the kind of marvelously circular reasoning that can be used to prove almost anything.

For example, an extreme feminist, out to prove that marriage exploits women, might redefine marriage as an institution that exploits women. Confronted with examples of women who had clearly benefited from their marriages, this feminist could then insist that, by her definition, these women were not actually married - licenses, weddings, vows, joint tax returns, joint property and even children not withstanding.

This confusion was exactly what privileged interests needed. It enabled privilege to hide behind genuine capital and to act as if genuine capital was under attack whenever privilege was under attack. That is, it enabled them to "red-bait" any critic of privilege as a socialist (something that bolsters the actual socialists), and it has maintained a general state of confusion among economists.

There are times, especially in microeconomics, when it is useful to have a term embracing anything that can be brought to bear for funding purposes. Fortunately, such a term already exists, and relieves conscientious economists from referring to everything of value as capital. That term is "assets."

"Capital" for "Capitalized Privilege"

Beneficiaries of privilege have funded economists who also conflate privileges with capital. Their argument is that these privileges are the same as capital because privilege value can be capitalized. While genuine capital has a production cost, and a value that must generally exceed the production cost (or else no more will be produced), privilege has no production cost, but rather creates an annual return that is "capitalized" into a selling price.

For example, if the holder of a taxi license can get so much a year over and above what he could earn without the license, the "capitalized" value, or selling price of the license, would be determined by whatever the buyer thought he could get per year from the license, compared to the return he could get from genuine capital. Then the gain in the expected value of the license can also be "capitalized" into a still higher price.

But this only shows that capitalized privilege is not capital, for the value of genuine capital does not have to be capitalized, any more than something that is truly sanitary has to be sanitized, a truly natural citizen has to be naturalized, or a word that is truly English has to be anglicized.

Socialists

are actually correct that the system they call capitalism is exploitive

of labor, but they fail to grasp that the private ownership of

privilege, rather than of genuine capital, lies at the root of that

system. That failure puts genuine capital at risk, because

the owners of genuine capital are fiercely competing with each other,

and are too busy to defend themselves

politically. In contrast, owners of privilege have nothing

to do but collect their dividends and defend their privilege. The

result is that socialist attacks tend to leave privilege intact while

undermining the ownership of genuine capital.

"Capital" for "Land"

This distinction between land and capital is one Marx most vociferously attacked. His rationale was stated most straightforwardly in the first of his "Economic and Political Manuscripts of 1844,"

This competition has the further consequence that a large part of landed property falls into the hands of the capitalists; thus, the capitalist becomes landowners (sic), just as the smaller landowners are, in general, nothing more than capitalists. In this way, a part of large landed property becomes industrial.

So, the final consequence of the abolition of the distinction between capitalist and landowner -- which means that, in general, there remain only two classes in the population: the working class and the capitalist class. This selling off of landed property, and transformation of such property into a commodity, marks the final collapse of the old aristocracy and the final victory of the aristocracy of money.

Note that this is an ad hominem

argument. While the classical economists were concerned with what is right and wrong, Marx was

concerned with who

was right and wrong. Yet a person can only become wrong by saying or

doing a thing that is right or wrong. It is impossible to have a

coherent ad hominem analysis without first having a coherent ad rem

analysis.

Suppose, for example, that all professional car thieves were also mechanics, mechanical skill being necessary to profit from car theft. Suppose further, as some people cynically assert, that all car mechanics are thieves. Does that mean that stealing cars has the same moral value as fixing cars? Clearly it does not. Yet Marx justified treating land as capital on the strength of his overstated premise that all landlords are capitalists and vice versa.

There is also the problem of conflated common usage. The person letting office space or apartments is commonly called a "landlord," even if the value of his property is 90% capital (i.e., the building itself) and 10% land. This person, who is called a landlord by common usage, is in fact 90% capitalist and 10% landlord.

In contrast, the United States Steel Corporation's most valuable and secure assets consist of vast holdings of coal, iron ore, natural gas and surface land. Furthermore, their competitive advantage over other steel companies is almost entirely due to their having monopolized the rights to these resources a long time ago, when land and resource prices were much lower. Yet US Steel is called a capitalist corporation, not a corporate landlord.

It is true that genuine capital must rest upon land, and that land rarely enjoys revenue without capital existing upon it. However, many commercial buildings are built on leased land, in which cases it is easy to separate the persons as well as the processes which determine the returns to land vs. capital.

It should also be noted that Marx's claim that "a large part of landed property falls into the hands of the capitalists" got the process backwards. That is, landlords collect rent from capitalists without having to own genuine capital, as classically defined. However, true capitalists cannot operate without renting or buying from landlords. Logically and empirically, we can see that capital fell into the hands of landlords and bankers rather than the other way around. The only way for Marx to obscure this self-contradiction was to redefine capital to include land, monetized credit issuance, and other capitalized privileges.

Classical economists (aka classical liberals) had proposed that all taxes be placed on the value of land. In Europe, where monarchy still prevailed, they argued from a pragmatic consideration - that land value is not produced by the title holder, and that, therefore, taxing land value does not inhibit production.

It is in vain in a Country whose great Fund is Land, to hope to lay the public charge of the Government on any thing else; there at last it will terminate. The Merchant (do what you can) will not bear it, the Labourer cannot, and therefore the Landholder must: And whether he were best do it, by laying it directly, where it will at last settle, or by letting it come to him by the sinking of his Rents, which when they are once fallen every one knows are not easily raised again, let him consider.

- John Locke, "Some Considerations on the Lowering of Interest," etc. p.60

Both ground-rents and the ordinary rent of land are a species of revenue which the owner, in many cases, enjoys without any care or attention of his own. Though a part of this revenue should be taken from him in order to defray the expences of the state, no discouragement will thereby be given to any sort of industry. The annual produce of the land and labour of the society, the real wealth and revenue of the great body of the people, might be the same after such a tax as before. Ground-rents, and the ordinary rent of land, are, therefore, perhaps, the species of revenue which can best bear to have a peculiar tax imposed upon them.

- Adam Smith, Wealth of Nations, Book 5, Chapter 2, Part 2, "Of Taxes"

Early Americans, freed from the shadow of monarchy, made the same case from moral grounds:

Whenever there are in any country uncultivated lands and unemployed poor, it is clear that the laws of property have been so far extended as to violate natural right. The earth is given as a common stock for man to labor and live on. If for the encouragement of industry we allow it to be appropriated, we must take care that other employment be provided to those excluded from the appropriation. If we do not, the fundamental right to labor the earth returns to the unemployed. It is too soon yet in our country to say that every man who cannot find employment, but who can find uncultivated land, shall be at liberty to cultivate it, paying a moderate rent. But it is not too soon to provide by every possible means that as few as possible shall be without a little portion of land.

- Thomas Jefferson, "Property and Natural Right," Letter to James Madison, Sr., from Fontainebleau, Oct. 28, 1785

[A]s it is impossible to separate the improvement made by cultivation from the earth itself, upon which that improvement is made, the idea of landed property arose from that parable connection; but it is nevertheless true, that it is the value of the improvement, only, and not the earth itself, that is individual property.

Every proprietor, therefore, of cultivated lands, owes to the community a ground-rent (for I know of no better term to express the idea) for the land which he holds...

There could be no such thing as landed property originally. Man did not make the earth, and, though he had a natural right to occupy it, he had no right to locate as his property in perpetuity any part of it; neither did the Creator of the earth open a land-office, from whence the first title-deeds should issue.

- Tom Paine, "Agrarian Justice," paragraphs 11-15

"Human capital" for "labor" (or "slave")

Once again, the three, mutually exclusive factors of production in classical economics were land, labor and capital, and the natural relationship is for labor to use or employ capital. That is, a carpenter uses a hammer to drive a nail, etc. Indeed, where land had not been thoroughly monopolized, that is what has happened. But labor needs not just something to labor with, but something to labor on. Once land had been monopolized, and base wages driven down to subsistence, laborers could no longer afford to educate themselves or develop skills that should increase their worth on the market, any more than they could afford to purchase their own tools and machinery.

At this point, owners of land and capital found that, to get skilled workers, they had to invest in the education of these workers. In order to acquire the skill-values they had given these workers, they endeavored to control the future of the workers themselves, through non-competition agreements (in which the worker could not seek employment with a competing firm that uses the same skills) or through debt, in which the worker borrowed heavily in order to get the skills needed to be employable.

None the less, one cannot own the skills

that are within a

person without, to some degree, owning or controlling the person

himself. To the degree that one owns or controls a person, one has

enslaved that person. "Human capital" is a euphemism for a cleverly

concealed slavery. It is tied to the earlier conflation of "invest" and

"acquire," for one can invest in the skills of one's employees, but one

cannot acquire a property in those skills without acquiring control

over the person

who actually has the skills.

"Single seller" for "monopoly"

To classical economists, monopoly was any restriction in the market that reduced competition and therefore allowed the beneficiaries to charge a premium over free-market prices. For example, this passage by Adam Smith is cited in the Oxford English Dictionary as one of the defining uses of the "monopoly":

The rent of the land, therefore, considered as the price paid for the use of the land, is naturally a monopoly price. It is not at all proportioned to what the landlord may have laid out upon the improvement of the land, or to what he can afford to take; but to what the farmer can afford to give.

- Wealth of Nations, Book 1,

Chapter 11, "Of the

Rent of Land"

This was what the American Progressives had in mind when they attacked monopoly as the enemy of free enterprise: land monopoly, banking monopoly, patent monopolies, shipping monopolies, tariff monopolies and so on, where established companies could increase their profits through privileges that restrict competition. New schools of "neoclassical" economics, funded by the very people who profited from these privileges, used the Greek origins of the word to redefine monopoly as a condition in which "a specific person or enterprise is the only supplier of a particular commodity or service." They thereby trivialized the problem of monopoly by trivializing the definition.

Some neoclassicals have gone so far as to

argue that even a

rail line between two cities is not a true monopoly if one can carry

freight by truck or ship, or can ship by rail over a more circuitous

route. Such usages defy the common-sense meaning of the word. When a

woman complains that "the men monopolized the conversation," try

telling her that it wasn't monopolized unless one man did all the

talking (or over 50% of the talking). See where that gets you.

Even neoclassical economists fail to object

to the use of the

term in

such statements as, "restrictions on the types of beer that could be

imported gave a monopoly to German brewers." After all, the point

of redefining the term was to take the heat off of the major monopoly

privileges enjoyed by patrons of the neoclassical school.

"Utility" or "Value in Use" for "Market Value" or "Value in Exchange"

Neoclassical economists generally, and

those from the Austrian

school particularly, set out to debunk the "labor theory of value."

Although they often say they are debunking "Marx's labor theory of value," the

theory was actually Adam Smith's. It was enhanced by David Ricardo,

whose "law of rent" showed that the rental component of value was a

function of how much labor could be saved by paying rent instead of

resorting to "marginal" land. Marx muddled this somewhat by supposing

these values would hold under a command economy when they actually

resulted from the "higgling of the market."

Had these Austrians confined themselves to the errors Marx had made, they might well have been on solid ground. However, to protect privilege from much broader challenges, they needed to discredit the labor theory of value in its entirety. They attempted to do this by portraying the labor theory as predicting the value of individual items to individual people. That, they said, was impossible because "all value is subjective."

The problem is that the labor theory of value was about the market value toward which prices would tend, which was substantially different from the personal utility value of a particular item. Smith was clear about this:

The word VALUE, it is to be observed, has two different meanings, and sometimes expresses the utility of some particular object, and sometimes the power of purchasing other goods which the possession of that object conveys. The one may be called 'value in use ;' the other, 'value in exchange.' The things which have the greatest value in use have frequently little or no value in exchange; and on the contrary, those which have the greatest value in exchange have frequently little or no value in use. Nothing is more useful than water: but it will purchase scarce any thing; scarce any thing can be had in exchange for it. A diamond, on the contrary, has scarce any value in use; but a very great quantity of other goods may frequently be had in exchange for it.

- Wealth

of Nations, Book I, Chapter IV, "Of the

Origin and Use of Money."

It is also clear that Smith was talking about the general market value and not the price of a particular item in a particular exchange.

And, lastly, what are the different circumstances which sometimes raise some or all of these different parts of price above, and sometimes sink them below their natural or ordinary rate; or, what are the causes which sometimes hinder the market price, that is, the actual price of commodities, from coinciding exactly with what may be called their natural price.

-

ibid.

Smith's actual theory was that, in

the absence of privilege,

the price of goods tends toward an equilibrium that reflects the cost

of

labor going into the manufacture of those goods. Although the

subjective value to each potential customer has a great deal to do with

how many items will be sold,

it has very little to do with the price. For example, the $400 computer

on which I am typing has far more utility than the $3,000 computer I

purchased in the 1980s. But the only thing that determines the price is

the production cost that the price has to overcome. In a free market,

this is the

labor cost plus land rent, prevailing interest, and a normal profit. If

a thing sells for more than this,

competitors will enter the market until the price falls to that

equilibrium. If it sells for less, competitors will leave the market

until the price rises. Hence, the labor cost is the price toward which

all products tend.

Obscuring the labor theory of value is

important to the defenders of

privilege, for it is a short step from that theory to the recognition

that labor is the source of all wealth, and that any return to

privilege is an expropriation from labor. However, subjective value

theory does more than obscure principles of justice. It makes simple

determinations of value unnecessarily complicated, and has followers of

the

Austrian school arguing that it is impossible to do what appraisers do

all the time - determine market value. It ends up with nothing having

value except in relation to other things, and denies the fundamental

relationship that Smith made clear:

The real price of every thing, what every thing really costs to the man who wants to acquire it, is the toil and trouble of acquiring it. What every thing is really worth to the man who has acquired it, and who wants to dispose of it or exchange it for something else, is the toil and trouble which it can save to himself, and which it can impose upon other people. What is bought with money or with goods is purchased by labour, as much as what we acquire by the toil of our own body. That money or those goods indeed save us this toil. They contain the value of a certain quantity of labour which we exchange for what is supposed at the time to contain the value of an equal quantity. Labour was the first price, the original purchase-money that was paid for all things. It was not by gold or by silver, but by labour, that all the wealth of the world was originally purchased; and its value, to those who possess it, and who want to exchange it for some new productions, is precisely equal to the quantity of labour which it can enable them to purchase or command.

This will not wash with those who

acquire wealth with no

productive toil and trouble. It ties directly to the observation that

the returns to privilege come out of the returns to other people's

labor, and that,

where privilege continues to grow unchecked, the return to labor tends

toward

subsistence. The ordinary person, who is supposed to be served by the

economy in a democratic republic, is treated like a commodity himself -

like human capital.

Privilege playing left against right

These euphemisms and dysphemisms have

gradually replaced

scientific language, sometimes to give a political advantage to the

left, and sometimes to give advantage to the right. Albert Jay Nock

called them "impostor terms."

However, the forces of privilege have

always been able to manipulate

the conflict by fueling whichever side best serves privilege at any

particular time. We saw, for example, privilege getting behind a

broadening of the income tax to make it increasingly fall on earnings,

and saw the bureaucratic left applauding this as a way to increase

government spending. Conversely, we saw the right seduced into opposing

real estate taxes based on the lie (that both the left and right had

swallowed) that these taxes fall mostly on the legitimate property of

ordinary home owners. We also see government socializing functions that

are rightly private when the left is dominant, and privatizing

functions that are rightly social when the right is dominant. Because

each is trying to get an advantage over the other, and because

privilege can throw its power behind whichever side avoids confronting

privilege, both sides have taught themselves to practice self-deception

for political advantage.

Indeed, if one looks at the impacts of these

euphemisms, one sees that

each serves a privileged interest. Yet, as the left is wedded to some

of these, the right is wedded to others, and privilege is wedded to

them all, it is difficult to shake them off. The only hope is that

there will arise a constituency that distances itself from the false

battles of left vs. right to focus, as the classical liberals did, on a

genuine science of political economy, and on genuine opposition to

privilege.

While this will never happen in an absolute

sense, there have been

times, and there will again be times, when the production of wealth is

honored and privilege is discredited. Such times have been marked by

increases in general prosperity.

We are interested in comments and questions that lead to light, not heat. Comments will be accepted or rejected accordingly.

Saving Communities

631 Melwood Avenue

Pittsburgh, PA 15213

United States

412.OUR.LAND

412.687.5263