Consequences of Speculationby Upton Sinclair

|

Saving Communities

|

||||||

Home |

Site Map |

Index

|

New Pages |

Contacts |

|

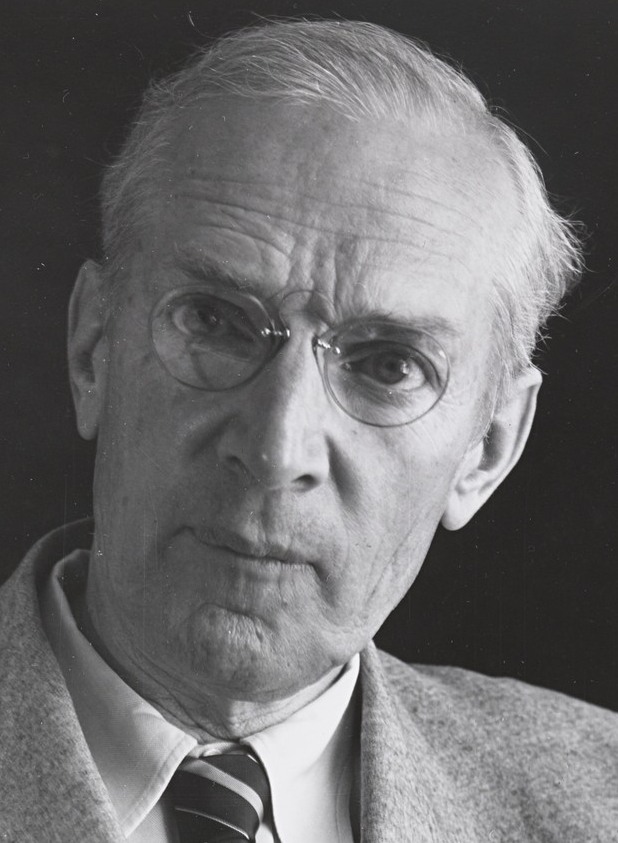

The Consequences of Land Speculation are Tenantry and Debt on the Farms, and Slums and Luxury in the Citiesby Upton Sinclairfrom Enclaves of Economic Rent, by C. W. Huntington, Fiske Warren, publisher, Harvard MA, 1924 |

I know of a woman - I have never had the pleasure of making her acquaintance, because she lives in a lunatic asylum, which does not happen to be on my visiting list. This woman has been mentally incompetent from birth. She is well taken care of, because her father left her when he died the income of a large farm on the outskirts of a city. The city has since grown and the land is now worth, at conservative estimate, about twenty million dollars. It is covered with office buildings, and the greater part of the income, which cannot be spent by the woman, is piling up at compound interest. The woman enjoys good health, so she may be worth a hundred million dollars before she dies.

I choose this case because it is one about which there can be no disputing; this woman has never been able to do anything to earn that twenty million dollars. And if a visitor from Mars should come down to study the situation, which would he think was most insane, the unfortunate woman, or the society which compels thousands of people to wear themselves to death in order to pay her the income of twenty million dollars?

The fact that this woman is insane makes it easy to see that she is not entitled to the "unearned increment" of the land she owns. But how about all the other people who have bought up and are holding for speculation the most desirable land? The value of this land increases, not because of anything these owners do - not because of any useful service they render to the community - but purely because the community as a whole is crowding into that neighborhood and must have use of the land.

The speculator who bought this land thinks that he deserves the increase, because he guessed the fact that the city was going to grow that way. But it seems clear enough that his skill in guessing which way the community was going to grow, however useful that skill may be to himself, is not in any way useful to the community. The man may have planted trees, or built roads, and put in sidewalks and sewers; all that is useful work, and for that he should be paid. But should he be paid for guessing what the rest of us were going to need?

Before you answer, consider the consequences of this guessing game. The consequences of land speculation are tenantry and debt on the farms, and slums and luxury in the cities. A great part of the necessary land is held out of use, and so the value of all land continually increases, until the poor man can no longer own a home. The value of farm land also increases; so year by year more independent farmers are dispossessed, because they cannot pay interest on their mortgages. So the land becomes a place of serfdom, that land described by the poet, "where wealth accumulates and men decay." The great cities fill up with festering slums, and a small class of idle parasites are provided with enormous fortunes, which they do not have to earn, and which they cannot intelligently spend.

This condition wrecked every empire in the history of mankind, and it is wrecking modern civilization. One of the first to perceive this was Henry George, and he worked out the program known as the Single Tax. Let society as a whole take the full rental value of land, so that no one would any longer be able to hold land out of use. So the value of land would decrease, and everyone could have land, and the community would have a great income to be spent for social ends.

A few years ago, out here in Southern California, a fine enthusiast by the name of Luke North started what he called the "Great Adventure" movement, to carry California for the Single Tax. I did what I could to help, and in the course of the campaign discovered what I believe is the weakness of the Single Tax movement. Our opponents, the great rich bankers and land speculators of California, persuaded the poor man that we were going to put all taxes on this poor man's lot, and to let the rich man's stocks and bonds, his inheritance, his wife's jewels, and all his income, escape taxation. The poor man swallowed this argument, and the "Great Adventure" did not carry California.

So, I no longer advocate the Single Tax. I advocate many taxes. I want to tax the rich man's stocks and bonds, also his income, and his inheritances, and his wife's jewels. In addition, I advocate a land tax, but one graduated like the income tax. If a man or a corporation owns a great deal of land, I want to tax him on the full rental value. If he owns only one little lot, I don't want to tax him at all. Some day that measure will come before the voters of California, and then I should like to see the bankers and land speculators of the state persuade the poor man that the measure would not be to the poor man's advantage! See editor's note

That this measure has not yet come before the voters of any state is due to the unfortunate fact that the Single Tax has become a dogma, just like any of the old-time devine revelations. You must take it just as Henry George recommended it, and if you suggest improvements on it you are a renegade, a betrayer of the sacred cause.

It was just about thirty years ago that Henry George ran for mayor of New York and did not get elected. In that time the Single Tax has been advocated in many places, and I believe it has yet to carry an election in the United States. So, naturally, there have been some discouraged Single Taxers, and it has occurred to some of them to try another method of applying their ideas. This is the method of the colony.

I have before me a little book entitled "Enclaves of Economic Rent," by C. W. Huntington.... This book is published by Mr. Fiske Warren, a millionaire paper manufacturer who lives at Harvard, Massachusetts, and believes in the Single Tax by way of enclaves.... I sought to persuade Mr. Warren that a great crisis was impending; that the inequality of wealth in our society a thing continually growing worse, was bound to bring a smash-up long before mankind had been persuaded to live in enclaves. To this Mr. Warren answered, in substance: "You may be right; but if this civilization collapses, something else will have to be put in its place, and it may be useful to men to have a model of a better community."

...How are these enclaves run? The principle is very simple. The community owns the land, and fixes the site value year by year, and those who occupy the land pay the full rental value of the land they occupy. Improvements of any kind are not taxed; you pay only for the use of what nature and the community have created. The community takes all this wealth and uses it, first to pay all the taxes on the land [and buildings -ds] the remaining money being expended for community purposes, by the democratic vote of all.

What this means in practice you can see from the town of Fairhope, Alabama. Fairhope began nearly thirty years ago, with three hundred and fifty acres, and now has nearly four thousand acres. Its land is estimated to be worth a million dollars. But instead of this wealth being distributed among private owners, in accordance with the guessing power or each individual, the whole rental value is the property of the community, and the whole community prospers by the labors of each one.

What this means in the way of moral values you may judge from one sentence in the little book: and I will follow the example of the book and quote this sentence in the same cold and unemotional fashion: "No resident of Fairhope has been defendent in a criminal case in county court." Perhaps I should add that there is no place except the county court where anyone could be a defendent; there has never been a court or jail or anything of that sort in Fairhope.

Or take the colony of Arden, Delaware, which is just south of Philadelphia. I could not say that no resident of Arden has ever been a defendent in a court - I myself having been one of eleven men who were arrested by a constable from the city of Wilmington, and sent to prison for the crime of playing baseball and tennis on Sunday! It is that kind of humourous story which you read about Arden, and not the serious efforts which are there being made to solve a great and pressing social problem.

In Philadelphia, as in all our great cities, are enormously wealthy families, living on hereditary incomes derived from crowded slums. Here and there among these rich men is one who realizes that he has not earned what he is consuming, and that it has not brought him happiness, and is bringing still less to his children. Such men are casting about for ways to invest their money without breeding idleness and parasitism. Some of them might be grateful to learn about this enclave plan, and to visit the lovely village of Arden, and see what its people are doing to make possible a peaceful and joyous life, even in this land of bootleggers and jazz orchestras.

Sinclair makes a good point about the Georgist movement being dogmatic, but that doesn't make his own approach the right one. What happened when socialist-leaning single-taxers like Upton Sinclair pandered to wealth-envy by proposing wealth taxes was that the privileged classes happily caved on the wealth taxes, so that now we do tax the rich man's stocks and bonds (and also the poor man's retirement funds) and his inheritances (if he is not rich enough to hold them overseas or otherwise shelter them). If there were a way to tax his wife's jewels, it would merely encourage rich people to buy more land and less jewelry, causing higher unemployment among jewelers and higher land prices for everyone. Also, as these various unprincipled measures have been disastrous, people have become suspicious of any proposal to tax the rich, including the one proper tax, for which Mr. Sinclair, had he not been impatient for cheap victories, might have held out.

- Dan Sullivan

Comments:

Saving Communities

420 29th Street

McKeesport, PA 15132

United States

412.OUR.LAND

412.687.5263