War on Wage Tax

|

Saving Communities

|

||||||

Home |

Site Map |

Index

|

New Pages |

Contacts |

|

He wages computer war on

wage tax

|

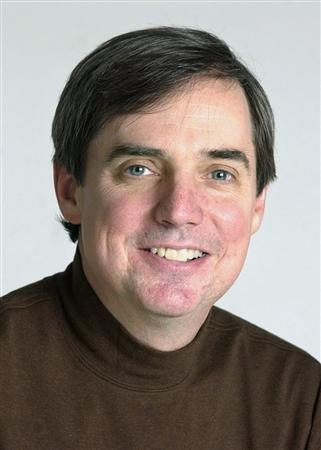

IN A MESSY upstairs office in an old wooden house on a dead-end street in Oakland, Dan Sullivan sits at his computer and plots a tax revolution.

He's a college dropout without a steady paycheck or an ounce of clout. But he's been at this 10 years, and every so often, his obsession gets him on a 77 bus Downtown so he can let City Council have it.

It's a plan for cutting the thing Pittsburghers hate more than blocked punts, the wage tax.

Sullivan says his enemy is also his best friend: math.

"If people were not afraid of mathematics they would sit down and do their math and they would all want land tax," Sullivan, 39, says. "The problem is the big shots do the math. The little people don't."

He thought he'd see more success this year, as Council Finance Chairman Jack Wagner was interested in Sullivan's ideas for shifting some of the tax burden from pay checks to pay dirt, from wages to land. But then Mayor Sophie Masloff pulled a wage-tax cut out of her bee hive and suddenly all the other would-be's felt the politics.

When you already have a tax cut, pure and simple, it's no time to tell people you're going to raise something else.

"They want to know the tax has been at cut and that's it," Wagner said.

Sullivan told council last week, OK, then next year, increase the tax on land, but not on buildings and other property, and cut the wage tax and other taxes some more. Pittsburgh's already the only big city in the country that taxes land more heavily than buildings (151.5 mills on land; 27 mills on buildings.) Let's keep going in that direction.

The "long and complicated and goofy" tax reform options that the state legislature approved last week didn't please him. Raising the sales tax would be bad news for working taxpayers and store-owners, be said.

Sullivan can reach into his briefcase and pull out the late mayor and governor, Davey Lawrence, to explain.

"There is no doubt in my mind that the (land) tax law has been a good thing for Pittsburgh," Lawrence once said. "It has discouraged the holding of vacant land for speculation and provides an incentive for building improvements.... It is particularly beneficial to homeowners."

A decade ago, City Councilman William Coyne and others pushed that argument and won land tax increases over the objections of Mayor Richard Caliguiri, who preferred wage tax hikes.

The yawn of approval could be heard across the city.

"You couldn't tell people what you were doing because people would fall asleep," Janes Rooney, Congressman Coyne's executive assistant, recalls.

But this stuff consumes Sullivan, right down to his business card that yells "Lower taxes to the ground!" He's a disciple of the 19th century economist Henry George, and he claims he and his ideological soulmates have helped shift a half-billion bucks in municipal taxes across the state in 10 years. Clairton recently went to the graded tax.

Yet the Pennsylvania Fair Tax Coalition is basically just Sullivan and a computer, with some support from Steven Cord, a retired professor of history and economics at the Indiana University of Pennsylvania, now living in Maryland.

Why has Sullivan, a bright, witty guy, shown the organizational talents of a hermit? This is the same guy who's the presiding officer of Western Pennsylvania Mensa, the high I.Q. club, and a sometimes tutor of college students.

"There are people in this world who understand economics and people who understand politics and very few who understand both. People like us are politically incompetent. And people who are politically competent have very little savvy in economics."

Sullivan points out, though, that the last time the land tax went up in Pittsburgh, we had the building boom of Renaissance II.

Critics call that a coincidence and say that that the land tax falls too heavily on commercial properties, people with rundown homes and retired homeowners.

Oh hell, Sullivan says, kill the mercantile tax, too. And if we keep driving working people to the suburbs, we're going to have to raise the property tax just to balance the budget.

He says he and his computer are there for the average Joe and Josie.

"If he tells me his wages, I can tell how much money he saves going from wage tax to land tax."

I say take him up on it. Sullivan's number is [now 412-687-5263]. His enemies might want to write that down, too. He's living with his one and only and she's bringing home the bacon and, well, you know how it is.

"I can be bought," he said, and you could see the smile over the phone, "if the real estate industry wants me to stop doing this."

(Brian O'Neill's column appear[ed] in the Pittsburgh Press every Wednesday, Thursday, Friday and Sunday.)

Brian O'Neill now writes for the Pittsburgh Post-Gazette.

Comments:

Saving Communities

420 29th Street

McKeesport, PA 15132

United States

412.OUR.LAND

412.687.5263