THE SINGLE

TAX

|

Saving Communities

|

||||||

Home |

Site Map |

Index

|

New Pages |

Contacts |

|

THE SINGLE

TAX

|

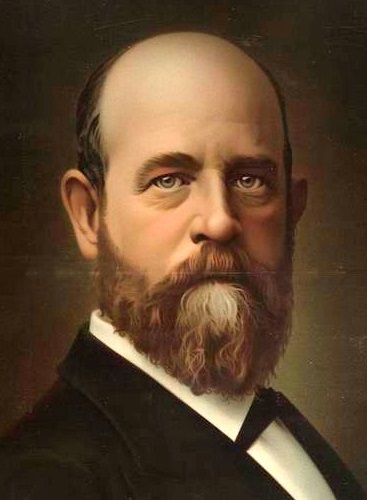

"I propose to beg no question, to shrink from no conclusion, but to follow truth wherever it may lead. Upon us is the responsibility of seeking the law, for in the very heart of our civilization to-day women faint and little children moan, but what that law may prove to be is not our affair. If the conclusions that we reach run counter to our prejudices, let us not flinch; if they challenge institutions that have long been deemed wise and natural, let us not turn back."

– Henry George in Progress and Poverty

I shall briefly state the fundamental principles of what we who advocate it call the single tax. We propose to abolish all taxes save one single tax levied on the value of land, irrespective of the value of the improvements in or on it.

What we propose is not a tax on real estate, for real estate includes improvements. Nor is it a tax on land, for we would not tax all land, but only land having a value irrespective of its improvements, and would tax that in proportion to that value.

Our plan involves the imposition of no new tax, since we already tax land values in taxing real estate. To carry it out, we have only to abolish all taxes save the tax on real estate, and to abolish all of that which now falls on buildings or improvements, leaving only that part of it which now falls on the value of the bare land, increasing that so as to take as nearly as may be the whole of economic rent, or what is sometimes styled "the unearned increment of land values."

That the value of the land alone would suffice to provide all needed public revenues – municipal, county, State, and national, there is no doubt.

To show briefly why we urge this change, let me treat (1) of its expediency and (2) of its justice.

From the single tax we may expect these advantages:

1. It would dispense with a whole army of tax gatherers and other officials which present taxes require, and place in the treasury a much larger proportion of what is taken from the people, while by making government simpler and cheaper, it would tend to make it purer. It would get rid of taxes which necessarily promote fraud, perjury, bribery and corruption, which lead men into temptation, and which tax what the nation can least afford to spare– honesty and conscience. Since land lies out-of-doors and cannot be removed, and its value is the most readily ascertained of all values, the tax to which we would resort can be collected with the minimum of cost and the least strain on public morals.

2. It would enormously increase the

production of wealth–

(a) By removal of the burdens that now weigh upon industry and thrift. If we tax houses there will be fewer and poorer houses; if we tax machinery there will be less machinery; if we tax trade there will be less trade; if we tax capital there will be less capital; if we tax savings there will be less savings. All the taxes therefore that we should abolish are those that repress industry and lessen wealth. But if we tax land values there will be no less land.

(b) On the contrary, the taxation of land values has the effect of making land more easily available by industry, since it makes it more difficult for owners of valuable land which they themselves do not care to use, to hold it idle for a larger future price. While the abolition of taxes on labor and the products of labor would free the active element of production, the taking of land values by taxation would free the passive element by destroying speculative land values, and preventing the holding out of use of land needed for use.

If any one will but look around to-day and see the unused or but half-used land, the idle labor, the unemployed or poorly employed capital, he will get some idea of how enormous would be the production of wealth were all the forces of production free to engage.

(c) The taxation of the processes and products of labor on one hand, and the insufficient taxation of land values on the other, produce an unjust distribution of wealth which is building up, in the hands of a few, fortunes more monstrous than the world has ever before seen, while the masses of our people are steadily becoming relatively poorer. These taxes necessarily fall on the poor more heavily than the rich; by increasing prices, they necessitate a larger capital in all businesses, and consequently give an advantage to large capitals; and they give, and in some cases are designed to give, special advantages and monopolies to combinations and trusts. On the other hand, the insufficient taxation of land values enables men to make large fortunes by land speculation and the increase in ground values– fortunes which do not represent any addition by them to the general wealth of the community, but merely the appropriation by some of what the labor of others creates.

This unjust distribution of wealth develops

on the one hand a

class idle and wasteful because they are too rich, and on the other

hand a class idle and wasteful because they are too poor– it deprives

men of capital and opportunities which would make them more efficient

producers. It thus greatly diminishes production.

(d) The unjust distribution which is giving us the hundred-fold millionaire on the one side and the tramp and pauper on the other, generates thieves, gamblers, social parasites of all kinds, and requires large expenditure of money and energy in watchmen, policemen, courts, prisons, and other means of defense and repression. It kindles a greed of gain and a worship of wealth, and produces a bitter struggle for existence which fosters drunkenness, increases insanity, and causes men whose energies ought to be devoted to honest production to spend their time and strength in cheating and grabbing from each other. Besides the moral loss, all this involves an enormous economic loss which the single tax would save.

(e) The taxes we would abolish fall most heavily on the poorer agricultural districts, and would tend to drive population and wealth from them to the great cities. The tax we would increase would destroy that monopoly of land which is the great cause of that distribution of population which is crowding the people too closely together in some places, and scattering them too far apart in other places. Families live on top of one another in cities because of the enormous speculative prices at which vacant lots are held In the country they are scattered too far apart for social intercourse and convenience, because, instead of each taking what land he can use, every one who can grabs all he can get, in hope of profiting by its increase of value, and the next man must pass farther on. Thus we have scores of families living under a single roof, and other families living in dugouts on the prairies afar from neighbors – some living too close to each other for moral, mental, or physical health, and others too far separated for the stimulating and refining influences of society. The wastes in health, in mental vigor, and in unnecessary transportation result in great economic losses which the single tax would save.

Let us turn to the moral side and consider the question of justice.

The right of property does not rest on human laws; they have often ignored and violated it. It rests on natural laws – that is to say, the laws of God. It is clear and absolute, and every violation of it, whether committed by a man or a nation, is a violation of the command "Thou shalt not steal." The man who catches a fish, grows an apple, raises a calf, builds a house, makes a coat, paints a picture, constructs a machine, has, as to any such thing, an exclusive right of ownership, which carries with it the right to give, sell or bequeathe that thing.

But who made the earth, that any man can claim such ownership of it, or any part of it, or the right to give, sell or bequeathe it? Since the earth was not made by us, but is only a temporary dwelling-place on which one generation of men follows another; since we find ourselves here, are manifestly here with equal permission of the Creator, it is manifest that no one can have any exclusive right of ownership in land, and that the rights of all men to land must be equal and inalienable. There must be an exclusive right of possession of land for the man who uses it must have secure possession of land in order to reap the products of his labor. But his right of possession must be limited by the equal right of all, and should therefore be conditioned on the payment to the community by the possessor of an equivalent for any special valuable privilege thus accorded him.

When we tax houses, crops, money, furniture, capital or wealth in any of its forms, we take from individuals what rightfully belongs to them. We violate the right of property and in the name of the state commit robbery. But when we tax ground values we take from individuals what does not belong to them, but belongs to the community, and which cannot be left to individuals without the robbery of other individuals.

Think what the value of land is. It has no reference to the cost of production, as has the value of houses, horses, ships, clothes, or other things produced by labor, for land is not produced by man, it has been created by God. The value of land does not come from the exertion of labor on land, for the value thus produced is a value of improvement. That value attaches to any piece of land means that that piece of land is more desirable than the land which other citizens may obtain, and that they are more willing to pay a premium for permission to use it. Justice, therefore, requires that this premium of value shall be taken for the benefit of all in order to secure to all their equal rights.

Consider the difference between the value of a building and the value of land. The value of a building, like the value of goods, or of anything properly styled wealth, is produced by individual exertion, and therefore properly belongs to the individual; but the value of land only arises with the growth and improvement of the community, and therefore properly belongs to the community. It is not because of what its owners have done, but because of the presence of the whole great population, that land in New York is worth millions an acre. This value therefore is the proper fund for defraying the common expenses of the whole population; and it must be taken for public use, under penalty of generating land speculation and monopoly which will bring about artificial scarcity where the Creator has provided in abundance for all whom His providence has called into existence. It is thus a violation of justice to tax labor, or the things produced by labor, and it is also a violation of justice not to tax land values.

These are fundamental reasons for which we urge the single tax, believing it to be the greatest and most fundamental of all reforms. We do not think it will change human nature. That, man can never do; but it will bring about conditions in which human nature can develop what is best instead of, as now in so many cases, what is worst. It will permit such an enormous production as we can now hardly conceive. It will secure an equitable distribution. It will solve the labor problem and dispel the darkening clouds which are now gathering over the horizon of our civilization. It will make undeserved poverty an unknown thing. It will check the soul destroying greed of gain. It will enable men to be at least as honest, as true, as considerate, and as high minded as they would like to be. It will remove temptation to lying, false swearing, bribery, and law breaking. It will open to all, even the poorest, the comforts, refinements and opportunities of an advancing civilization. It will thus, so we reverently believe, clear the way for the coming of that kingdom of right and justice, and consequently of abundance, peace and happiness, for which the Master told His disciples to pray and work. It is not that it is a promising invention or cunning device that we look for the single tax to do all this, but it is because it involves a conforming of the most important and fundamental adjustments of society to the supreme law of justice; because it involves the basing of the most important of our laws on the principle that we should do to others as we would be done by.

The readers of this article, I may fairly presume, believe, as I believe, that there is a world for us beyond this. The limits of the space have prevented me from putting before them more than some hints for thought. Let me in conclusion present two more:

1. What would be the result iu heaven itself if those who got there first instituted private property in the surface of heaven and parceled it out in absolute ownership among themselves as we parcel out the surface of the earth?

2. Since we cannot conceive of a heaven

in which the equal

rights of God's children to their Father's bounty is denied, as we now

deny them on this earth, what is the duty enjoined on Christians by the

daily thought, "Thy kingdom come, Thy will be done, on earth as it is

in

heaven"?

Comments:

Saving Communities

420 29th Street

McKeesport, PA 15132

United States

412.OUR.LAND

412.687.5263