How to Destroy the Rum Power

|

Saving Communities

|

||||||

Home |

Site Map |

Index

|

New Pages |

Contacts |

|

How to Destroy the Rum Power

|

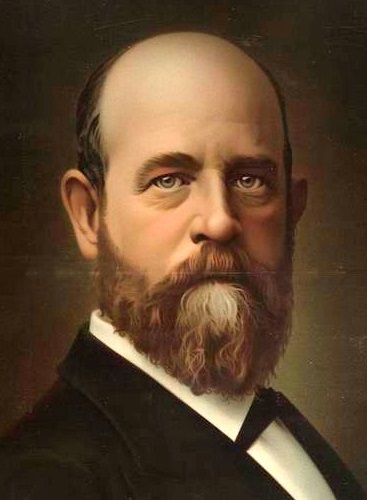

This article was written by Henry George as result of a meeting with Mr. B. O. Flower, editor of The Arena and The Twentieth Century magazines. Mr. Flower says that he had suggested to Mr. George that he prepare an outline of his social and economic philosophy, but to his surprise was told by Mr. George that he would much prefer to write a paper in advocacy of free rum, to be one of a series of articles Mr. Flower had told him he was having prepared dealing with various aspects of the temperance problem. On Mr. Flower expressing astonishment at Mr. George’s choice of a subject, the latter replied:

“Mr. Flower, interperance is a great curse; we all admit that. But there is something more deadly than intemperance threatening the republic today, and that is political corruption. The rum power in politics is a greater evil than intemperance, and it has arisen and become the evil that it is today — an evil that is poisoning th epolitical conscience fo the nation — because of restrictive legislation. Restrictive legislation,” he repeated, “is the cause, and the rum power in politics is the effect.”

From another friend of Mr. George, very close to him at the time, we have the following statement:

Henry George, the Rev. Dr. Howard Crosby, and a distinguished woman of the time [about 1887 or 1888] were invited to debate the liquor question at the Academy of Music in Brooklyin. The woman advocated absolute prohibition, Dr. Crosby advocated high license, and Mr. George, in beginning his speech, after hearing them both, said that he agreed with the woman’s argument against Dr. Crosby’s, and with Dr. Crosby’s against the woman’s; whereupon he advocated absolute freedom in the matter, doing so in the interest of temperance.

For years the liquor question has been largely and widely discussed in the United States. But the discussion has turned on the kind and degree of legal restriction that ought to be applied to the manufacture and sale of intoxicating drink, and the political effects of this restriction have been but little considered. The “rum power” has been sufficiently recognized and bitterly denounced; but without inquiry into its nature and causes, has been generally treated as one of the evils that make restriction necessary.

Yet the political influence of the various interests connected with the manufacture and sale of liquor is a matter of sufficient importance to demand some consideration in itself, and apart from the question of temperance. For the “rum power” is certainly a fact of the first importance. It is an active, energetic, tireless factor in our practical politics, a corrupt and debauching element, standing in the way of all reform and progress, a potent agency by which unscrupulous men may lift themselves to power, and an influence which operates to lower public morality and official character.

Intemperance is a grave evil. But it is not the only evil. Political corruption is also a grave evil. The most ardent advocate of temperance would probably admit that there may be a point where the one evil may be outweighed by the other, and would hesitate to accept the total abstinence that prevails in Turkey if accompanied with Turkish corruption of government. There is no instance in which intemperance among a civilized people has stopped advance and turned civilization back towards barbarism, but the history of the world furnishes example after example in which this has occurred from the corruption of government, ending finally in corruption of the masses.

While the lessening of intemperance may be the most important end that under present conditions we can seek; while it may be that in our liquor legislation we should disregard all other effects if we can secure this, it is nevertheless wise that we should at least consider what these effects may be. In the presence of the giant evils springing from the existence of the “rum power” in our politics, it is certainly worth while to inquire how the existence of this power stands related to our restrictive liquor legislation.

A little consideration will show that they are indeed related, and that this relation is that of cause and effect. Not as is generally assumed, the rum power being the cause and the restrictive legislation the effect of opposition aroused by it, but the restrictive legislation being the cause, and the appearance of the “rum power” in politics the effect of this restriction.

This we may see from general principles, and a wide experience. While there is any possibility of changing them through political action, legal restrictions on any branch of business must introduce into politics a special element, which will exert power proportioned to the pecuniary interests involved.

We restrict the importation of wool by putting a duty on wool and immediately there arises in our politics a wool power to send lobbyists to Washington, to secure the nomination and election of members of Congress, to exert an influence upon party organization and conventions and to contribute to political corruption funds. We put a duty on iron and at once there arises an iron power to log-roll and bulldoze, to bribe and corrupt, to use our politics in every way for the defense or promotion of its special interests, and uniting with other special interests of the same kind to exert such influence on the organs of public education and opinion as to make the great body of the American people actually believe that the way to make a people rich is to tax them. We interfere with the industry of making cigars by imposing an internal revenue tax on cigars, and as a consequence we have a league of cigar manufacturers ready to spend money and to exert political influence to maintain the tax, which, by concentrating business, gives them larger profits. The match industry is comparatively very small; yet the tax on matches imposed during the war begot a match power which though not large enough to cut any figure in the politics of the country at large, was sufficient to be perceptible at Washington when the question of reducing taxes came up. Or, to take a case where the popular reason for the restriction is of the same kind as that for restriction on the manufacture and sale of liquor, we have put a high duty on opium. Hence the growth of a combination or combinations on the Pacific Coast, making some millions a year by smuggling opium. To make sure of the retention of the duty and keep in place officials blind eyed to the operations of the smugglers, the pecuniary interest thus created must take part in politics — for under our system the power to get votes and to manage conventions is the foundation of the power to make laws and secure appointments.

If such be the effects of simple restrictions what must be the effect of such restrictions as we impose on the manufacture and sale of intoxicating liquors. What would they be on any other business? There are people who believe the wearing of corsets a deleterious habit, greatly injurious to American women. Others contend that wearing corsets in moderation is harmless if not helpful, and that it is only the excess of tight lacing that is injurious. But without concerning ourselves with this we can readily imagine the effects of applying to the corset business the restrictions now imposed on the liquor business.

If the Federal Government were to put such a tax on the manufacture of corsets as it does on whiskey, we would soon have a corset ring, with large pecuniary interests in the retention of the tax, in the rulings of the department, and in the appointment of internal revenue officials.

If corset selling were restricted by licenses as is liquor selling, the privilege would become valuable, and its holders have reason to “keep solid” with the dominant party. Where it was prohibited, illicit sales, it is risking nothing to predict, would still go on. These illicit sellers would all the more need the favor and connivance of officials owing their places to politics, and must therefore use their influence and spend their money in politics.

Just what would thus follow from corset restrictions has followed from liquor restrictions. The effect of the tax on the manufacture of liquor is to concentrate the business in the hands of larger capitals and stronger men, and to make evasions a source of great profit. It is thus directly to concern large pecuniary interests in politics, in order to maintain the tax and to influence or control the officials concerned with its administration.

This is the genesis of the American whiskey ring, which sprung into the most pernicious activity with the imposition of the two dollar per gallon tax, — a tax which led to the most wide-spread political debauchery and corruption. The reduction of this tax to fifty cents a gallon — accomplished against the efforts of the ring — has greatly reduced this corruption and lessened the political influence of the whiskey ring.

But it still exists, as it will exist while the tax on liquor remains a potent factor in national legislation, bringing its money and its influence into all elections where its interests are even remotely affected. Here is what Hon. Earnest H. Crosby, in an article in the May Forum, entitled “The saloon as a political power,” has to say of one branch of it:

The brewers deserve special notice. Their immense wealth gives them opportunities for wholesale bribery. They raise enormous funds for use in all canvasses in which the temperance issue is raised. But the brewers have a greater power than mere riches. Each brewery has a large number of beer-shops under its direct control. They select men-of-straw, provide the money to establish them in business, and take back chattel mortgages on the saloon fixtures. They thus gain absolute possession of the mortgagor, body and soul, and he follows their directions in politics implicitly. One firm of brewers in a leading city holds six hundred chattel mortgages of this kind, aggregating $310,134 in value. Another has two hundred and eight, valued at $442,063. We can see in a moment the concentration of power which such a system affords. The saloons in order to rule must combine, and here is a plan of combination already provided. One example will show how this power is used. Two years ago the brewers in a strong Democratic district determined to send an attorney of theirs, Sir. A. P. Fitch, to Congress. They secured the Republican nomination for him. The -Democratic bar-rooms were ordered to support him, and he was elected. While serving his term in Congress, the Mills Bill, leaning toward free trade, came up for consideration. The brewers were in favor of reducing the surplus in this way, as they desired the internal revenue to remain untouched. Mr. Fitch left his party and voted for the Mills Bill. The brewers turned to, obtained the Democratic nomination for him, and elected him again in the same district.

Not entirely the brewers. Men like myself voted for Mr. Fitch, as we always will vote in favor of a Republican who inclines to free trade, or indeed a Republican protectionist, as against a Democratic protectionist. As to the political influence of the liquor power in New York Mr. Crosby is right. It was thrown against me in solid mass when I ran for mayor in 1886. A deputation came to me to ask what my course if elected would be. My reply was that so far as it might devolve on me, I would enforce the law without fear and without favor. But I have no reason to think that this had any effect on the action of the liquor men. They supported Mr. Hewitt because the Excise Commissioners and the Police Department were in his favor.

It is high time that these brewers were brought to their senses. They sustain the internal revenue system because it keeps others from competing with their monopoly, and also because they buy their revenue stamps at wholesale, at seven and one-half per cent, discount, and charge them to their customers at par. One well-known firm is said to make $28,000 a year by this arrangement. In their effort to preserve the internal revenue, the brewers support tariff reduction, and even free trade; but only in so far as it does not injure them.

In Great Britain the excise system has produced the same effects — the concentration of the business, the accumulation of enormous fortunes, the control of public houses by brewers and distillers and the building up of a political power which is a bulwark of Tory conservatism and an obstacle to all real reform and advance.

To tax liquor is inevitably to call a “rum power” into politics. Where the liquor sellers do not throw their money and influence into politics of their own volition they are forced to do so. In New York, for instance, the influence and the contributions of the liquor sellers are controlled by the party of factions that control the excise commissioners and the police department, and the liquor sellers are compelled to use their influence and give their money at every election. Indictments are found for violations of excise regulations and corded up in pigeon holes by the thousand, never to be taken down unless the saloon keeper is recalcitrant, while spasmodic raids and arrests enforce the necessity of keeping on the good side of the powers that be.

And besides the work that is compelled and the “voluntary contributions” that are exacted for party, there is special service and ransom to individual officials and politicians. This is one of the reasons why such enormous amounts of money are spent in New York even in trivial election contests and why officials grow rich on small salaries. This enormous liquor influence, organized, disciplined, and controlled through the very laws intended to lessen the evils of intemperance, is one of the great agencies which have made democratic government in the true sense of the term as nonexistent in New York as in Constantinople.

As it is in New York so is it in degree at least in other cities. Where licenses are limited in number they become but the more valuable. When they are raised in price the number of unlicensed liquor sellers who are even more under the control of corrupt politicians than are the licensed ones, increase.

In Philadelphia the adoption of high license and the placing of the power to grant licenses in the hands of judges of the courts has produced remarkable results in diminishing intemperance and crimes growing out of it. But “a new broom sweeps clean.” And whether the ultimate result in this respect be good or bad, it is certain that in the long run the political power growing out of the liquor business will not be diminished, and that the pecuniary interests involved in the traffic will enter into the nomination and election of judges.

Prohibition puts liquor selling under the ban of the law. Hence where liquor selling continues, as it does in every prohibition State, it must be by connivance of officials and by favor of politicians. Thus the work and the money of the illegal liquor sellers build up a “rum power" relatively stronger than where restriction has not been carried to the length of prohibition. In Maine, where prohibition has been longest tried, it is said to be the control of the illicit sellers of liquor which keeps the State in the hands of the Republican party — not because it is the Republican party, of course, but because it is the party in power.

In Iowa, where ingenuity seems to have exhausted itself in framing legal provisions to absolutely prevent either the manufacture or the sale of liquor, the returns of the United States Commissioner of Internal Revenue show that United States license taxes were paid during the last fiscal year by 7 rectifiers, 25 wholesale liquor dealers, 2,758 retail liquor dealers, 41 brewers, 50 wholesale dealers in malt liquors and 223 retail dealers. These people did not pay United States special taxes out of patriotism. If so many of them paid these United States taxes, how much must they, and the far greater number not thus returned (the proportion of 41 brewers and 50 wholesale dealers to 223 retail beer sellers is very significant), have paid as hush money and political subscriptions?

The more carefully the subject is examined the more clear I think it will appear that to eliminate the “rum power” as a corrupting element in our politics by restrictive laws is hopeless. On the contrary it is restriction that brings it into our politics. There is only one way of eliminating it from politics, and that is by doing away with all restrictions, from Federal tax to municipal license, and permitting “free trade in rum.”

To many people this will seem like saying that the only way of getting rid of the trouble of keeping pigs out of a garden is to throw down the fences and let them root at will. Others will see in the increase of intemperance which they will associate with free trade in liquor, greater evils than the corrupting political influence of the “rum power.” Yet even if this be so, it is at least worth while to see that in attempting to cure one evil by restriction we are creating another.

But is it so? To abolish all taxes on liquor would be to make liquor cheap and easily obtained. But would this be to increase drunkenness?

Is there more intemperance in countries where liquor is relatively cheap than in countries where it is very dear? Did the two dollar tax on whiskey lessen drunkenness? Did the reduction to fifty cents increase it? Is there more drunkenness among the rich whose power to purchase all they want is not lessened by the artificial enhancement in the cost of liquor than there is among the poor, on whose power to purchase this enhancement must most seriously tell? Is it not notorious that men too poor to get proper food, clothing, shelter for themselves and their families do still manage to get drunk? And among the temperate men or total abstainers who read this page, is there one whose abstinence is due to the costliness of liquor?

All our restriction, even to the point of absolute legal prohibition, does not, except perhaps in some places to strangers and in some small communities, really prevent the man who wants liquor from getting it. Where it even closes the open saloon it only substitutes for it the drug store, the club room, the back door and the kitchen bar.

On one Sunday in New York I had to ride from the upper end of the island to the Astor House to get a little liquor for medicinal purposes, but it was only because one of the periodical raids against Sunday selling was on, that I was a stranger, and perhaps that I looked like a temperance man. People known to the saloon keepers or druggists could get all they wanted. I have never lived in a prohibition State, but I have never been in one where there seemed any difficulty in getting liquor. In Burlington, Iowa, I saw saloons openly doing business; in De Moines, I saw young men drunk in the hall of the principal hotel at mid-day; in Lewiston, Maine, I was recently told that there were some three hundred places where liquor was sold, mostly kitchen bars; and in a Vermont town a prosecuting attorney, even then prosecuting some offenses against the prohibitory law, took me into his back room and producing a bottle and glasses from a closet and setting them on the table remarked, “It is against the law to sell or to give liquor as a beverage, but there is no law to prevent a man from taking it if he sees it lying around.”

But the artificial enhancement in the cost of liquor by taxation and restriction does have the effect of promoting adulteration. With no tax whatever upon spirits they would be too cheap to make adulteration pay. But every artificial increase in cost is a premium on the substitution of poisonous mixtures for the pure article. The abuse of liquor is bad enough; but there can be no question that much of the evil that is attributed to liquor is due to adulterations not really entitled to the name. Dr. Willard H. Morse, in the North American Review, says: “If two puppies are fed, the one on the whiskey of the saloons, and the other on the purest product of distillation, the autopsy of the former will show a diseased brain, while the brain of the latter will be found to be normal.” Drug store whiskey is reputed worse than saloon whiskey, and the worst whiskey of all is said to be prohibition whiskey.

And the effect of these poisonous adulterations which our restrictions promote and encourage is, it must be remembered, not merely to make the drinking habit more deadly, it is to produce a quicker and stronger craving on the part of those who partake of the stuff, and thus to make confirmed drinkers - to produce a diseased condition of body and mind which urges the victim to satisfy the insane craving at all risks and costs.

That the abolition of all taxes on the manufacture and sale of liquor would increase the consumption of liquor is doubtless true. It would increase its consumption in the arts and for domestic purposes; but that it would increase its consumption as a beverage is not so clear. For there are certain exceptions to the general rule that consumption is inverse to cost. Where a depraved appetite is the cause of consumption no increase of cost that we have found practicable, will reduce consumption, and where ostentation prompts consumption, decrease of cost is apt to lessen it. If invention were to reduce the cost of diamonds to a cent or two a pound their consumption in the arts would much increase, but their consumption for personal adornment would cease. Where sturgeon are scarce and costly, their meat is esteemed a delicacy and placed before guests; where they are very plenty and cheap they are thrown out of the nets or fed to pigs.

The most ardent temperance men, whether favoring high license or prohibition, will not contend that in the present conditions of society it is possible by any amount of legal restriction to prevent liquor drinking. But they will contend that restriction tends to discourage the formation of the drinking habit, by lessening the temptations to begin it.

Now the great agencies in the formation of the drinking habit are social entertainment, the custom of treating, and the enticements of the saloon.

Does restriction tend in the slightest degree to discourage the setting of liquor before guests in private houses and at social entertainments? There is probably less of this in the prohibition States than in the non-prohibition States, and there is certainly less of it now in all sections than there was in preceding generations when the restrictions were less or did not exist. But this is not because of prohibition or restriction, but because of the stronger moral sentiment against liquor drinking, and of which the restriction or prohibition is one of the manifestations. No man disposed to drink or to set drink before others in private, refrains from doing so because of any statute law. Legislatures may impose penalties, but they have no power to make people think wrong what before they deemed right. Prohibition may have some little effect on public and official entertainments, and the increased cost of liquor may have some effect in preventing it being set before guests. But on the other hand the prohibition of what is not felt to be wrong in itself provokes a certain disposition to it, and the greater costliness of a thing prompts the offering of it to those we would compliment. The treating habit which springs from a desire to compliment or to return a compliment, is certainly strengthened by the costliness of liquor. Millionaires do not ask each other to go out and take ten cents’ worth of whiskey or five cents’ worth of beer when they want to be complimentary or sociable. But men to whom five or ten cents is an object do, and unless the treat is in discharge or recognition of some obligation they feel themselves bound to return it in kind.

Now with liquor so cheap as it would be if there were no tax or restriction on its manufacture and sale, the treating habit would certainly be largely weakened. If whiskey were as cheap as water, it would entirely die out. Who thinks of treating another to water, or feels the refusal of another to empty a glass of water into his stomach a slight; or imagines that because one man offers a glass of water to each of a party that each one of the party must in his turn offer a glass of water to all the others?

As for the saloon, the license system makes it more gorgeous and enticing; while prohibition drives it into lower and viler forms. What really would be the effect of absolute free trade in liquor? At first blush it may seem as if it would be to enormously multiply saloons. On second consideration it will seem more likely that it would utterly destroy them. This is certain, that if anywhere that saloons exist a proposition were made to do away with all tax, license, or restriction, the saloon keepers would be its most bitter opponents. And they would quickly assign the reason, “If everybody were free to sell liquor we would have to go out of the business.”

The liquor saloon as we know it is a specialization which can only exist by the concentration of business which restriction causes. Were liquor as cheap as it would be were all taxes on it removed, and were everyone free to sell it, it might be sold in every hotel, in every boarding or lodging house, in every restaurant, druggist’s, bakery, confectionery, grocery, dry-goods store, or peanut-stand, but places specially devoted to its sale could not be paved with silver dollars, or ornamented with costly paintings, or set fine free lunches, or provide free concerts, even if indeed they could continue to exist. And where liquor was sold in connection with food, entertainment, or other things, and at the prices which free competition would compel, it would not pay to let men drink themselves into intoxication or semi-intoxication or in any way to provoke or encourage the drinking habit.

In short, I believe that examination will show that the sweeping away of all taxes and restrictions, would not only destroy the “rum power” in our politics, but would much decrease intemperance.

And this view has the support of one of the keenest of observers. Adam Smith, who treats this matter at some length in Chap. 3, Book IV, of the Wealth of Nations, says:

If we consult experience, the cheapness of wine seems to be a cause, not of drunkenness, but of sobriety. The inhabitants of the wine countries are in general the soberest people in Europe.

People are seldom guilty of excess in what is their daily fare. Nobody affects the character of liberality and good fellowship, by being profuse of a liquor which is cheap as small beer.

When a French regiment comes from some of the northern provinces of France, where wine is somewhat dear, to be quartered in the southern, where it is very cheap, the soldiers, I have frequently heard it observed, are at first debauched by the cheapness and novelty of good wine; but after a few months’ residence, the greater part of them become as sober as the rest of the inhabitants. Were the duties upon foreign wines, and the excises upon malt, beer, and ale to be taken away all at once, it might, in the same manner, occasion in Great Britain a pretty general and temporary drunkenness among the middling and inferior ranks of people, which would probably be soon followed by a permanent and almost universal sobriety.

“Almost universal sobriety,” wrote Adam Smith in Kirkaldy, somewhere in the early seventies of the eighteenth century. Writing as the wonderful nineteenth century nears its final decade and in the great metropolis of a mighty nation then unborn, I can say no more, if as much. The temperance question does not stand alone. It is related — nay, it is but a phase, of the great social question. By abolishing liquor taxes and licenses we may drive the “rum power” out of politics, and somewhat, I think, lessen intemperance. Thus we may get rid of an obstacle to the improvement of social conditions and increase the effective force that demands improvement. But without the improvement of social conditions we cannot hope to abolish intemperance. Intemperance today springs mainly from that unjust distribution of wealth which gives to some less and to others more than they have fairly earned. Among the masses it is fed by hard and monotonous toil, or the still more straining and demoralizing search for leave to toil; by overtasked muscles and overstrained nerves, and under-nurtured bodies; by the poverty which makes men afraid to marry and sets little children at work, and crowds families into the rooms of tenement houses; which stints the nobler and brings out the baser qualities; and in full tide of the highest civilization the world has yet seen, robs life of poetry and glory of beauty and joy. Among the classes it finds its victims in those from whom the obligation to exertion has been artificially lifted; who are born to enjoy the results of labor without doing any labor, and in whom the lack of stimulus to healthy exertion causes moral obesity, and consumption without the need of productive work breeds satiety. Intemperance is abnormal. It is the vice of those who are starved and those who are gorged.

Free trade in liquor would tend to reduce it, but could not abolish it. But free trade in everything would. I do not mean a sneaking, half-hearted, and half-witted “tariff reform,” but that absolute, thorough free trade, which would not only abolish the custom house and the excise, but would do away with every tax on the products of labor and every restriction on the exertion of labor, and would leave everyone free to do whatever did not infringe the ten commandments.

A year before the Wealth of Nations was published, Thomas Spence, of Newcastle, in a lecture before the philosophical society of that place, thus pictured such a state of things:

Then you may behold the rent which the people have paid into the parish treasuries, employed by each parish in paying the government its share of the sum which the parliament or national congress at any time grants; in maintaining and relieving its own poor and people out of work; in paying the necessary officers their salaries; in building, repairing, and adorning its houses, bridges, and other structures; in making and maintaining convenient and delightful streets, highways, and passages, both for foot and carriages; in making and maintaining canals, and other conveniences for trade and navigation; in planting and taking in waste grounds; in providing and keeping up a magazine of ammunition, and all sorts of arms sufficient for all its inhabitants in case of danger from enemies; in premiums for the encouragement of agriculture, or anything else, thought worthy of encouragement; and, in a word, in doing whatever the people think proper; and not, as formerly, to support and spread luxury, pride, and all manner of vice.

There are no tolls or taxes of any kind paid among them by native or foreigner but the aforesaid rent, which every person pays to parish, according to the quantity, quality, and conveniences of the land, housing, etc., which he occupies in it. The government, poor roads, etc., as said before, are all maintained by the parishes with the rent, on which account all wares, manufacturers, allowable trade employments or actions are entirely duty free. Freedom to do anything whatever cannot there be bought; a thing is either entirely prohibited, as theft or murder, or entirely free to everyone without tax or price.

Saving Communities

420 29th Street

McKeesport, PA 15132

United States

412.OUR.LAND

412.687.5263