The Income Tax

|

Saving Communities

|

||||||

Home |

Site Map |

Index

|

New Pages |

Contacts |

|

THE INCOME

TAX

|

The World calls on me to abandon my absurd theory of taxing land values, and to support instead an income tax as a means of relieving working men of unjust burdens.

If the World sees no further, and is prepared to advocate an income tax in lieu of other means of raising public revenue, or any, considerable part of it - as, for instance, that now collected at our custom house by onerous duties upon the bringing into the country of things the people want - it would give me much pleasure and would do a great public service. For the income tax has some great advantages over the indirect taxes, by which so much of our revenues are raised. Unlike those taxes, it does not check and hamper production, and it does not fall upon the, poorest class with far more weight than upon the richest class. It does not aim to tax a man upon what he consumes, but, which is much more rational, upon what he receives. And any discussion by such a powerful journal as the World of the income tax as a substitute for these indirect takes would at least cause thousands of people to see their disadvantages, and to get at least such a first lesson in the incidence of taxation as would enable them to realize that in taxing capital they are not taxing the capitalist, and that in levying duties on the entrance of foreign productions they are not taxing the foreigner but taxing themselves.

But while for these reasons I should think the advocacy by the World of an income tax in lieu of worse taxes would be a step in advance, I myself cannot advocate. it. My aim is not merely "to relieve the working people of unjust burdens," but to relieve all people of unjust burdens; and, believing as I do in the sacredness of property rights, I would not tax any man who has a large income, for that reason alone, any more than I would tax a man with a stall one. I am neither a socialist nor a communist, and have no quarrel with rich people because they are rich. If men are to-day able to get large incomes by reason of monopolies which permit them to appropriate the proceeds of other peoples toil, I would abolish these monopolies, and not, while leaving the cause of the unjust distribution of wealth in full operation, endeavor somewhat to equalize things by taxing incomes. Whatever any man may fairly earn, whether by his labor, his skill, his capital or his organizing ability, without interfering with the equal rights of others, I would leave entirely to him, and not tax him a penny on that account, even though his income amounted to millions.

But without

reference to objections of this kind, which the World may consider theoretical,

there are certain very obvious objections to the income tax which are

enough to discredit it, even if otherwise no objection could be made.

Like the greater part of our present taxes, but even more directly and

obviously than most of them, the income tax, when an attempt is made to

apply it, becomes a tax not so much upon income as upon conscience.

This was abundantly shown during the period in which the national

government imposed a tax upon incomes. The tax gatherer can ascertain

the incomes of men who work for salaries or wages, and in most cases,

at least, of those whose incomes, as in the case of many widows, and

orphans, are derived from property held in trust or under guardianship;

but there is no possible way by which he can ascertain the incomes of

business men, capitalists, speculators and others, who as a class, have

the largest incomes. The consequence is that an income tax, even with

all inquisitorial devices that can be suggested, is easily evaded by

the very classes upon whom its advocates would have it fall, while it

not infrequently happens that business and professional men are

compelled, by the fear of the injury that might be done them were the

smallness of their real incomes known, to make a false return

and pay a tax larger than the law designs.

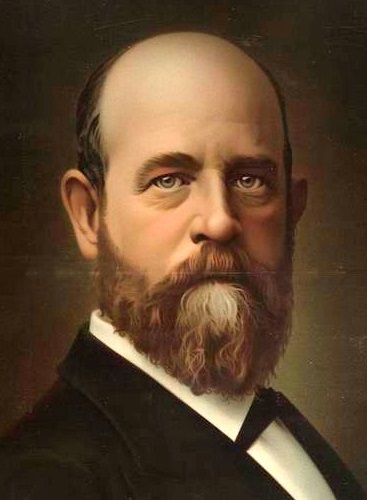

Signed: Henry George,

November 19, 1887.

Saving Communities

631 Melwood Avenue

Pittsburgh, PA 15213

United States

412.OUR.LAND

412.687.5263