Influential Convert to Single Tax

|

Saving Communities

|

||||||

Home |

Site Map |

Index

|

New Pages |

Contacts |

|

An Influential Convert to

the Single Tax

|

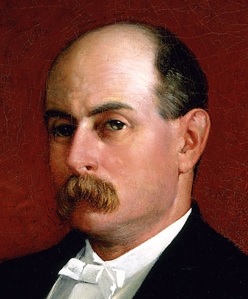

Mr.

Charles Francis Adams has written a letter to the

President of the Massachusetts Single Tax League, declaring himself a

cordial supporter of the single-tax proposition, and suggesting a

method by which the experiment could be tested. In stating his

position Mr. Adams says:

The single tax would be an enormous improvement over the existing sytsem, or over any other system which I think could be devised. It would reduce taxation to a basis of absolute certaintly and fairness, rendering evasion impossible. A complete stop would thus be put to the whole system of cheating, and consequent unjust transfer of a burden from those who have a conscience. This argument alone, to my mind, woud be conclusive in favor of the single tax. Any possible amount of wrong or injury it might incidentally inflict would, to my mind, be little more than dust in the balance compared with the advantage which would result after the thing fairly adjusted itself, from the complete freedom it would bring about from all temptation to evasion and false swearing. From the moral point of view, consequently, there do not seem to be any two sides to the question; and the moral point of view is, in my judgment, the all-important point of view.

As to the practical effects of the single tax, he says that if the amount of the tax were limited to the necessities of the government economically administered, he, as an individual landowner, would not be troubled by the talk about confiscation, since the removal of all his other taxes would benefit him as much as the double or treble taxation of his land would injure him. Indeed, he believes that the indirect effect of removing all taxes from improvements would be an enormous stimulus to industry, and thus cause in the cities an increase in the general wealth. In the rural districts, however, he believes the single tax would work immediate disadvantage to teh farming population. In the town of Lincoln, for example, where Mr. Adams has a country residence, the adoption of a single tax would cut his taxes in two, while he judges that it would double or treble the taxes of his neighbors who make their living by farming. Per Contra, Mr. Thomas G. Shearman, in his "Natural Taxation," has given some figures to sustain his contention that under the single tax, involving as it does a large increase in taxation of town and city land, and also a tax on railroad franchises, farm taxation would be reduced rather than increased.

Try the experiment

Mr. Adams believes that a fair trial of the experiment can most easily and most safely be secured through a system of local option permitting each town to raise its taxes as it sees best. There is no doubt that, in advocating a local option system of this sort, the single-taxers are moving toward their end along the line of least resistance. Nevertheless, the resistance to this system will be much stronger than Mr. Adams seems to realize when he goes on to say that he cannot see what reason can be urged against it. Thus far the Massachusetts Legislature has resisted every attempt to put an end to the double taxation of certain forms of property, and a local option bill such as described would be resisted with far more vigor as an obvious attempt to get rid of the single taxation of personal property. Counting the taxes collected by the State authority upon the stock of banks, manufacturing corporations, and railroads, nearly two-fifths of the taxes in Massachusetts are derived from personal property - though it must be remembered that the single tax regards the railroad as land. A bill permitting any town to attract residents or business from its neighbors by exempting personal property would be regarded as a bill to overthrow the wold system of taxing personal property and would array against itself the "vested interests" of all citizens who own relatively more real estate than personalty, to say nothing of the vested rights of those whose real estate consists almost exclusively of land.

Comments:

Saving Communities

420 29th Street

McKeesport, PA 15132

United States

412.OUR.LAND

412.687.5263